What’s a big Cricket shot have to do with a company valuation? One of the first things I tell investors is that we go for the risky, big shots, even if it means there’s a chance of striking out.

Summary

Our next equity crowdfunding round on Seedrs commences at the end of January. One of our core company values is transparency with stakeholders, and hence we are explaining the rationale behind the valuation of this round in this post.

- Our last round post-money valuation was £6.7m. During the last 14 months, we have gained more traction, including clients such as Seedrs and WiseAlpha, and launched premium subscriptions featuring on-demand translation plus paywall-free and non-public content from 225+ major publications including New York Times, Fitch, Washington Post, and more. To attract sufficient talent, we have to issue more stock options, increasing the total number of shares and options. Employees who accept options in lieu of cash are also contributing to the increased value of the company. Moreover, we have received two six-figure grants from Malta and agreed to collaborative efforts with the University of Malta. We believe that this IP-generating initiative in Malta will raise the valuation of the company significantly. After adjusting for the Maltese grants, the pre-money valuation for the new round is only a 16% jump from the last round. We believe that this is the minimum appreciation that we need to provide to our existing investors for the risk taken and employees for all the effort made.

- For us to be able to serve major institutional clients, we have had to invest heavily in product development and infrastructure monitoring to identify and fix any issues. We live by the lean philosophy and have managed to keep our costs low, building, maintaining, and improving everything with just £1.8m in raised funds, £250k+ in R&D credits from HMRC, and £300k-worth of free credits from cloud providers including Amazon, Google, Microsoft, and IBM. Any major organisation building a similar proposition would have spent £10m+ for a similar time period as we have taken, and, as a slow-moving bureaucratic organisation, they may still not have provided good results. We believe that irrespective of the users, revenue, and profit, our product and team provide significant value to existing major organisations in this space and could be an acquisition target. If an acquisition were to happen, it could provide exponential returns to investors. A similar company, Kensho, was acquired by S&P Global for $550m.

- Most of our competitors and major fintechs around the world have raised much more money in single rounds than our entire valuation. Instead of burning cash to generate growth at any cost, we are focused on building a cash flow positive and self-sustainable business. This significantly derisks our downside and will result in a significant jump in valuation when we break even.

- Our existing investors will also join the round at the same valuation. We expect a significant number of our 1,200+ investors on Seedrs to join this round.

- Valuations of companies have shot up significantly during the last five years due to the following reasons:

- The cost of building a business has risen considerably. With unemployment at a record low, salaries inflation is very high, especially in the tech world. Moreover, marketing costs, especially online, have jumped up significantly; Facebook and Google have been announcing bumper numbers!

- GBP has depreciated substantially against other currencies, and this forces up the valuation in GBP.

- Exit valuations also seem to have gone up significantly due to the low-interest-rate environment and a healthy economy.

- The flow of investment capital into Silicon Valley tends to see start-ups raise $1m at $4m pre-money valuations in the seed stage. The UK is just catching up with Silicon Value.

As a value investor, I look to buy assets quoted below their ‘intrinsic’ value. At CityFALCON, we wanted to make sure that our crowdfunding round is reasonably valued and adequately compensates investors for the risks involved in investing in start-ups. This is part of our effort to make this particular crowdfunding campaign more transparent than any other.

If you’d like to learn more about this fundraising round, visit our invest page here.

Full Details

Only a 16% increase in the valuation from the last round:

We closed our £750K round on Seedrs in Feb 2019 at a post-money valuation of c. £6.7m.

We have achieved a lot since our previous round, and that may warrant a higher valuation, but we believe a more conservative valuation will be more appealing to more people, increasing the success of our crowdfunding campaign.

Here is what we have achieved in the last 14 months:

- Improved infrastructure and significant backend improvements (sufficient for HMRC R&D rebates, too)

- Launched several major features

- Implementation of complex-query watchlists, a major technical feat and strong competitive edge over incumbents

- The categorisation and delivery of data by location, from continents down to cities (further drill down, like Wall Street or Canary Wharf, coming soon)

- A service to extract basic data from LSE RNS filings and deliver filing PDFs

- The build out of several features and the associated systems

- Tech on the brink of going live:

- Sentiment analysis

- Spam probability scoring

- Textual summarisation across sectors and even entire watchlists

- Filings from many other regulatory agencies, including the SEC and Companies House UK

- Cleaner and smooth UI and UX on web, mobile, and voice

- Launch of a new revenue stream, Premium subscriptions, to bundle features together in a consumer-friendly but revenue-generating way

- Gained new clients for our enterprise API

Two six-figure grants and an academic collaboration project

Beyond what we have achieved with customers, technology, and feature implementation, we have also secured funding from Malta Enterprise for hundreds of thousands of euros in the form of two non-equity-dilutive, non-taxable, non-loan grants: one for business development and one for an R&D project with the University of Malta. Not only does this contribute to our valuation in terms of incoming cash, it brings credence for the team, our ideas, and our momentum for a government entity to provide so much support and for a University to be interested in working with us.

More than just the cash raising our valuation, a post-doc will work with us full time for the duration of the project, the salary paid by the University, and CityFALCON will own any jointly-developed foreground intellectual property. Thus the cash infusion, the post-doc researcher, and the potential for IP all form some of the basis for the rise in valuation.

The basics of valuation

The price of any financial asset depends on two factors – supply and demand. The supply and demand for any given financial asset, however, is determined by numerous other factors. Here are a couple of examples:

- The price of property in the cities of London, New York City, and Mumbai is much higher than the price of identical property in other cities, even though very similar raw materials, labour, and technology were used to develop it. Here, supply is forced into a small area while demand is extremely high, with even many non-residents purchasing property in these cities.

- The price of crude oil is almost entirely determined by supply and demand. In the past couple of years, there has been a global over-supply of oil, coming from increased North American production paired with a dramatic response from OPEC to increase their own output at the same time. This huge increase in supply, without the matching increase in demand, sent oil prices plummeting worldwide and has kept them low except in times of geopolitical instability.

Inflation can lead to overvalued financial assets as credit and capital flow more freely through the system. This is partially attributable to “cheap credit”, which attracts entrepreneurs and others to fund their otherwise financially-infeasible ideas, as they can easily pay the low interest rates, while in “expensive credit” situations, such infeasible ideas cannot afford the interest rates long enough to break even. During these periods, we see some start-ups and ‘unicorns’ issue equity and raise capital at unbelievably high valuations.

Fundamental value, however, is also relative and could move up and down as we gather more data and gain a better understanding of the particular asset and sector. Demand may shift as more data becomes available, especially in the age of Big Data, when business decisions are based on the latest data. If supply does not rise at the same rate, valuations can skyrocket. Moreover, new markets may also arise very quickly, and some valuations are based on future demand that has yet to materialise.

Example: Many product-based tech companies, such as Facebook, Google, and Snapchat, when just starting out, did not have substantial revenues. Few people, if any, foresaw how integral Facebook and Google would become to industries like marketing, where little demand existed for “social media advertising” and SEO before but now often dominates marketing strategy. These companies are valued very differently from companies with a proven business model and revenues, such as IBM, Microsoft, and Apple.

Recommended reads

Avoid start-ups that undervalue themselves

Of course, valuation is never black and white. It is impossible to determine the future performance of a company based on its current valuation. However, and perhaps counterintuitively, if you feel that the company you are investing in is too undervalued, it should put some doubts in your mind. My personal concerns with companies that undervalue themselves are:

1) They may fail to raise sufficient capital and become insolvent before they can become profitable. Low cash can easily pull management’s time away from product and customer development into managing cash flows just to survive.

2) If the valuation is low and the initial capital provided by the founder is low, the entrepreneur does not have the ‘skin in the game’ to prevent jumping ship to a full-time corporate position. Or, if the valuation remains too low, a highly vested entrepreneur may lose motivation due to less-than-expected capital appreciation.

3) If they are underselling to current investors, they may consistently undersell, including their product to customers, increasing the chances of losing out on traction while a more aggressive competitor captures market share. Furthermore, how can investors expect that future fundraising rounds won’t be conducted at a similarly low valuation, providing little return on investment.

Recommended Reads

- How does an early-stage investor value a start-up? Seedcamp

- The Mystery of UK Start-up Valuation (CityFALCON Blog)

- How start-up Valuation Works – Measuring a Company’s Potential

Product and service companies need to be valued differently

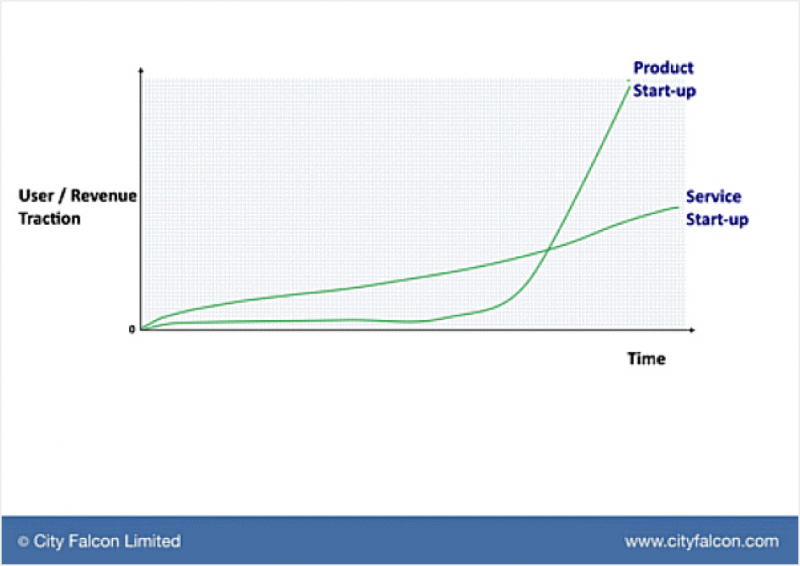

Most investors apply user and revenue traction as their standard investment criteria. Number of users, number of active users, monthly revenue, and revenue projections are the most common metrics for these criteria.

Product-based start-ups are inherently higher risk, and naturally, investors don’t like risk, despite their desire for higher returns. It is for this reason that we don’t see product-based start-ups, such as Facebook, Linkedin, and Twitter, coming out of the UK, where risk appetite is substantially lower than tech hotbeds like Silicon Valley. During the product development phase, customer and revenue numbers are low – no one is buying a half-finished product – and these are the two metrics most investors look at. Here at CityFALCON, we have had to spend more than 2 years building our product!

So what’s the difference between a product and a service-based start-up? Service start-ups deliver value by doing specialised work for someone else, immediately meeting a demand of the market. Think of a property rent-to-let model, outsourcing software development, or a design agency – all of these are service start-ups. They perform work that people need without creating an entirely new object or product to sell. Product start-ups, of course, require something to sell that generally isn’t performing specialised work – though the line is starting to blur with automation start-ups, where a product is actually performing a service.

Service companies can potentially record revenues within 1-2 months. Most of the training, skills, and knowledge were built through education and experience before the employees are hired. Contrarily for product companies, you have to “burn” some cash while you build a product that did not exist prior to its development. Some product companies that are successful today didn’t generate any revenues within their first year of operation, focusing on building the product, not selling.

At the same time, the product development phase cannot happen in a black box without inputs. In fact, quite the opposite: during most of the product-building stage, you should constantly request feedback and tweak the product along the way. Even though early customers may not pay you anything at all, their suggestions matter, because you cannot improve the product for the wider public without input from the public. The successful product-based start-up needs to make sure that what they are building solves a problem and that there will be active demand for their product upon its completion. Unfortunately, during this development period, you cannot pursue users and revenue with a half-finished product – half-finished products risk turning customers off before they even start – and this presents the funding challenge.

So with all of these deterrents, why would anyone build a product-based start-up when you have to burn cash for so long? It’s the upside and scalability of the project. With most well-built, finished products, the entire team can be on the beach and new users will continue to purchase and generate revenue. There will always be some aspects to polish and new suggestions to consider, but the general public is happy to purchase your product as it is, no more inputs required. In a service start-up, you may need to hire more people or add more resources for each increment in revenue. You cannot take on more software projects with the same number of developers without losing quality, so you hire more developers, increasing the costs in the top half of the income statement.

Recommended Reads

- Why I Would Think Twice Before Building a PRODUCT start-up Again in the UK (CityFALCON Blog)

- How to Scale a Business: Not All Business Models Are Created Equal

- Service vs Product – Running a Service Business is Hard But is Running a Product Business any Easier?

We have a product that clients think kicks arse

Our product is in no way perfect, and there is plenty of work to do, but it’s much better than several other existing options for investors and traders. This is doubly true for the retail and SME segments, who are either underserved by expensive platforms or must give up their privacy in order to use free or cheaper platforms.

We believe in building a product that sells itself, similar to the strategies previously adopted by start-ups Slack and Atlassian. For that reason, we do not have a sales team, though we do employ a modern marketing team that focuses on search engine optimization (SEO) and growth hacking to increase exposure. Strong SEO means companies that need our product can find us, and we don’t have to expend resources on a dedicated sales team. For the product itself, we focus on quality designs that attract users and, of course, quality substance in the form of strong features and aggregated content relevant to our users.

A testament to our method, even in our early stage, we are supporting a big bank, BNP Paribas, a major financial markets player IEX Group, and have FinTech and other companies integrating our API within their systems. For many whitelabelled data feeds, the customer includes attribution, like “Powered by CItyFALCON”, which increases exposure and helps customers find us. Since these customers are already looking for financial content, they provide the perfect demand for us.

Furthermore, early consumer traction and feedback has been positive. However, don’t take our word for it, try the platform out for yourself! Every new user gets a seven-day trial.

Looking to the future, over the coming months, we look to automate most of the onboarding steps for business clients, providing these users with the freedom to analyse our platform’s capability, customise a pricing plan, select between various widgets and a full API, download customisable code, and get started immediately. We’ll also release several features that are on the verge of implementation, further improving customer satisfaction. Thanks to our focus on automation, the CityFALCON team can sip margaritas on the beach while the product sells itself – the very embodiment of the highly scalable product start-up discussed above. Revenues can flow in while costs remain relatively the same.

Recommended reads

- This $5 Billion Software Company Has No Sales Staff

- No salespeople for us, says CEO of $4 billion start-up Slack

Most start-ups in Silicon Valley raise $1m at $4m pre-money valuation

In the realm of technology businesses, scale comes before profit. Focusing on profits and gaining more customers without scaling first leads to more website downtime and thereafter a rapid drop in customer satisfaction. Moreover, because the internet is global and instantaneous, internet-based company growth is faster and greater than traditional businesses, requiring scale from the start to ensure the onslaught of potential users does not overwhelm the system. The target market in the fintech industry is quite large, and scale is necessary for any serious player. Silicon Valley recognises this, and therefore valuations within the region are much higher than other tech sectors, including the UK, across the globe.

In order to build a scalable, satisfactory product, considerably capital is necessary. This makes fintechs, with their large target markets and need of scale, more capital intensive than other types of start-ups, even other product startups. Perhaps because money is at risk, customer reactions tend to be harsh and swift. A few seconds of downtime because of heavy load may not affect a service like YouTube much, but if users rely on the platform to make financial decisions, a few seconds can be very important indeed.

Investors are willing to value fintech companies at such valuations, despite the lack of revenues, because they are aware that in order to achieve the returns they desire, the company must use their seed capital to build a quality and scalable product. This strategy has been proven in the past, with examples such as Snapchat raising millions based off of user traction alone – their users may not have paid anything for the product, particularly while it was still under development, but the potential for scale and the associated revenues were significant enough to engender very high valuations.

This understanding in Silicon Valley leads to companies raising a quarter of their value in single rounds very early in their lifecycles, potentially even their first funding round. As a UK company, we shy away from this to ensure we receive sufficient investment from a risk-averse climate, but the concept remains: our company is building a product that requires significant upfront capital in order to generate impressive future scaling and profits.

Recommended Reads

Opportunity cost is too often overlooked

A potential investor once said to me:

“If your start-up fails what will you lose? I’ll lose my money, while you’ll get a job”.

While this may be true for VC-funded CEOs with little vested interest, this is not the case for me. CityFALCON is my baby, into which I’ve poured 5 years of my life, working weekends and holidays, plus substantial amounts of my own capital and, of course, the opportunity costs of a steady, secure corporate job. I’ve been told she only has a 10% chance of succeeding, but I’ll do whatever it takes to keep her alive. This drive to keep my start-up afloat has sometimes come at the cost of my health, my relationships, and every other facet of my personal life. However, I truly believe that if you’re not obsessed with your start-up, you’re wasting your time.

How far are we willing to go to support the business? I tossed all doubts aside and jumped into freezing water in the dead of the Finnish winter, just for the exposure (and a shot at the competition’s prize). Watch my full pitch from an ice hole in the frozen Baltic Sea here.

And this is where opportunity cost is overlooked. I clearly cannot both run a company and have another job, especially when the company is a start-up that is chronically short of quality, affordable employees. Thus, I cannot move to a steady corporate job, which is certainly more stable and probably pays much better than my current salary, too, as compensation is ballooning in the tech world. A start-up is a five, six, or seven-year-long play, sometimes with huge personal salary cuts to conserve cash. You can see this long-term commitment from prior start-up exits, and from the reverse vesting terms that VCs add to your term sheets. So when investors give you money, it is important to remember that as an entrepreneur, you are also contributing. You’re committing, at least, the next 5 years of your life, your blood, and your sweat (and sometimes your tears) to your start-up.

It’s true that alternatives can never be truly calculated perfectly, but we can still make a rough estimate of the pure monetary opportunity cost (to say nothing of the lost weekends, holidays, and other perks of 9-to-5 jobs). Let’s say an entrepreneur with the skillset to start a business can earn at least £75K per year. This is a conservative estimate, and the number could be as high as £200K-300K depending on the level of experience and the location. Therefore, the discounted opportunity cost for an entrepreneur over a five year period could be as high as £1m in high-paying areas like London. If we were to quantify the costs of perks like holiday time and how that might affect family life and health, we could arrive at even higher opportunity costs. If the start-up fails, that time, of course, is lost with no realisation of high payout from equity, while a corporate position with a high salary will of course still have paid the salary and benefits.

Recommended reads

High capital requirements also lead to higher exits

As mentioned above, due to the need to fund the development phase until the product is scalable, often with little revenue, investment capital can be quite high at the beginning. Not only is a scalable product necessary, but tech salaries are also rapidly growing, particularly for those with financial acumen or interest. Moreover, due to less overlap between finance and technology – as opposed to say technology and engineering or technology and science – the supply of individuals who meet both criteria is lower than in other industries, further inflating salaries.

Since the cost of building the product is high, and the combination of a strong tech team and a scalable product is paid by investment capital before revenues can be realised, higher multiples are afforded upon acquisition.

Recommended reads

- Why Investors Should Get Excited about the FinTech Revolution (CityFALCON Blog)

- Fintech’s $138 Billion Opportunity

Corporate build out would cost far more

Corporations have significantly more resources at their disposal to attract top employees, particularly the ability to pay higher cash salaries and better perks with wider networks of partners offering discounts and exclusives. Start-ups rely on the huge upside potential of employee stock options to compensate for their lower salaries. The agility of start-ups also means lower costs and shorter timeframes, while bureaucracy and siloing at large institutions regularly push projects way over budget.

In our opinion, if a financial institution were to build the same product as CityFALCON, the discounted value of projected expenses in building this product, in London, would be much higher than our entire valuation. That implies the build out of the product from us provides significantly more upside to investors and employees than a similar product at an existing large corporation would provide.

I also have a personal hypothesis that the chances of failure for internal corporate projects is higher than that at start-ups. Reasons for this include the vested interest of employees through stock options, more employee say in affairs and thus more motivated employees, and the weeding out of poor performers early because individual visibility is so high.

With these ideas in mind, our valuation range appears fairly conservative.

Relationships have value, and we have existing relationships with influential players

In a results-oriented atmosphere like financial investing, sometimes the metrics overpower other sources of value that are harder to quantify. One critical aspect of business is relationships, even if most of the focus is on numbers. While not all of our relationships are currently generating revenue, they could easily materialise into paying customers in the future. Remember, the product building phase tends to keep customers from large commitments, but they still provide feedback, which we incorporate. Then, once the product is ready, the customer trusts us, knows us, and likes the product as we have taken their suggestions into consideration.

One such example is a university with whom we’ve been in close contact as a customer (not the R&D partner). While we push through the last few phases of development, our contacts at this university are happy to wait because they know the final version will be exactly to their needs. This is the power of relationships in business.

We aren’t the only ones to praise our product

A lot of companies have great ideas but no product yet, so they rely heavily on marketing their idea over everything else. And while it’s true that finding customers is hard even with a great product, proof in the form of awards certainly makes it easier to entice the early adopters – who are trusted by the mass market to test a product, making them fundamental to sales in the future.

To this end, we have received several awards and recognition from organisations across the globe. In 2015, we placed second at Twitter’s global start-up competition, and first in the ‘Next Big Idea in FinTech’ competition from Ministry of Ontario. CityFALCON finished within the Final 10 at the Standard Bank Global PathFinders Challenge, and within the Final 10 in the EMEA group at the UBS Future of Finance Competition. Most recently, we won the Seedrs Scale Up Award for 2019 – and because scale is vital for a product start-up, this is a very good omen.

More of our recent recognition can be found here.

Our existing investors will also join the round at the same valuation

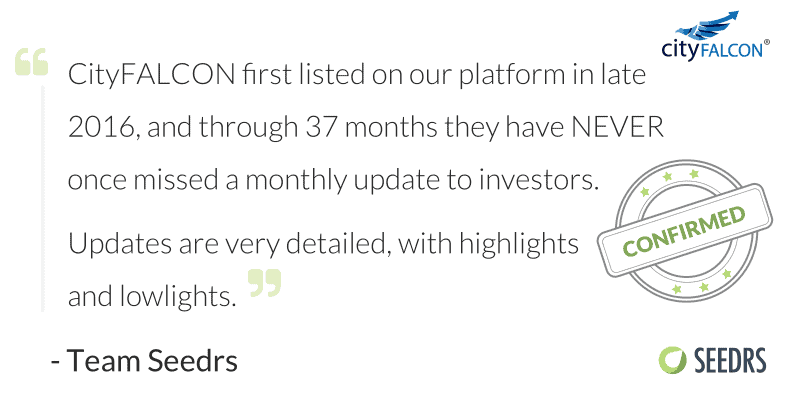

Our current investors are very motivated to see CityFALCON succeed and will contribute to this round of crowdfunding at the same valuation level as everyone else. The fact that these investors have the confidence to re-invest at this level of valuation should convey to you that at this range, there is substantial potential for greater returns in the future as we continue to scale, partner, market, and develop the platform. Please note that the amounts prior investors will invest may be much lower than what they had contributed in previous rounds.

One of the many reasons cited is our transparency and continual updates to investors. Some companies take the money and go silent for long periods of time. Seedrs, our crowdfunding platform, requires updates every 3 months, but we believe in open communication with investors, so we send updates every month. In the 37 months since our first funding round, we have never missed a monthly update. This gives our investors confidence that we are not prodigally spending their cash and they can better track progress.

Reasonable valuation helps to attract and retain talent

As mentioned above, start-ups have to use stock option upside to attract talent that would otherwise go to large corporations with steady jobs and higher salaries. With a reasonable move upward in value, employees who currently hold options can see the value of those options grow, instilling confidence in them that their work is paying off. It also helps to keep the top talent we’ve gathered from jumping ship to corporate positions. No appreciation at all would risk demotivating employees who have worked hard – after all, their work is what is powering the valuation higher – and potentially cause some to abandon the company. As our product requires intimate knowledge, especially from the developers, large scale exodus would be a severe setback.

For new employees, the cash-to-option conversion will be based on the current valuation. Since all options are issued at the same strike price as investors pay, if we value too high, newcomers won’t see the same potential for upside. If we value too low, they have to contend with dilution from future funding rounds just to keep the company afloat. Just like we outlined in the Avoid Undervalued Start-ups section, undervaluing the round will cause management to focus on cash conservation, potentially alienating new employees, and will likely have to issue more shares to cover costs, thus diluting current share- and optionholders’ value.

Our competitors have raised more money than our valuation

Previous valuations applied to our competitors have been similar, or much higher than the range we are applying to CityFALCON. We believe this is a product of a couple factors, including the premium Silicon Valley is willing to pay as opposed to the UK.

Examples include PitchBook, with a £175m valuation, markit, which merged with IHS and was estimated at £3.3bn, and a very close competitor, Selerity, which had raised $14.5m before it was acquired for an unknown sum (Silicon Alley premium, perhaps, as they were based in New York City). A company in a similar content undertaking, Dataminr, has raised £450m, also based out of New York, while Indian competitor Heckyl has raised just under £6m, in a similar range as us.

Exits in the FinTech space will be at higher valuations

Many investors are concerned about whether investing at the current valuation will provide them ample return. If a start-up is valued too high, the investor may be paying too steep a premium, and it is possible they will not see a profit throughout the holding period. This is also true for employee stock optionholders. Looking at past FinTech exits, however, we believe that we have selected a conservative valuation range, with plenty of growth potential.

- In July 2015, SS&C Technologies acquired Advent Software for ~$2.83 billion.

- In April 2016, Ally Financial acquired Tradeking Group for ~$275 million.

- In February 2014, BBVA acquired Simple for ~$117 million.

- In May 2017, Liquidnet acquires OTAS Technologies.

- In May 2017, Euronext Acquires 90% of FastMatch for $153m.

- In 2016, Cheetah Mobile bought News Republic for $57m, then the following year Cheetah sold News to ByteDance for $86m

- In August 2019, Refinitiv was acquired by LSE for £22bn

We are relatively less expensive compared to other FinTech raises in London

Relative to the valuations applied to some other FinTech funding rounds that have occurred in London, and it goes without saying in Silicon Valley, we are inexpensive.

- Tandem raised £22m at a £65m pre-money valuation in 2016, with a further £50m in funding and venture rounds in 2017 and 2018.

- Mondo raised £6m at a £30m pre-money valuation.

- Revolut raised £8m at a £40m pre-money valuation and a crowdfund of £3.8 at £275m later.

- Wise Alpha raised £3m in their latest round with a £9.6m valuation.

- Wealthify raised £1.1m at a £9.7m pre-money valuation.

- Tickr raised £1.1m at a £9.5m valuation

- Smarterly raised £2.5 at £16.7m

- Abundance Investment raised £1.6m at a £16.5m valuation

- CapitalRise raised £2.3m at £16m valuation then another £1.1m at £18.4 in the same year

Here are some of the seed rounds raised by FinTech start-ups

- Revolut: £1.5m

- Mondo: £2m

- Money Dashboard: £2.7m

- Yoyo Wallet: £0.9m

- TransferWise: £1m

Summary

We believe that the focus on user and revenue traction is not the right way to evaluate this investment opportunity. In fact, if that is the basis of your investment, we are probably not the right company to invest in. If you believe in the opportunity, and our team and its ability to deliver based on the product you can see thus far, we would love to hear from you. Learn more here.

Leave a Reply