Founder-CEOs are the people who start a company, grow it, and then continue to run it once it has become a large corporation. Some of the most famous names are Steve Jobs, Bill Gates, and Mark Zuckerberg. Are founder-CEOs better for company performance than “professional CEOs”, the people who have business backgrounds and come in from outside to run a company? The people who started the company have certain characteristics and a deep connection with the company, after it. But are they any better at running the company? According to some recent research analysed by Harvard Business Review (‘HBR’), there is some truth to that idea.

You can track personalised news for all the companies on our award-winning platform CityFALCON here.

Why do founder-CEO companies perform better?

HBR thinks there are three reasons, which they term insurgency, front-line obsession, and owner’s mindset. Venture capitalists Andreessen Horowitz mention comprehensive knowledge, moral authority, and a commitment to the long term in a blog entry about the topic. What are all these things?

-

The Insurgency

The “insurgency” refers to upending the market and the desire to continue to innovate. As founders, they had to do something unexpected to carve out their niche. This may have been finding an underserved demographic (Netflix – home delivery rentals) or creating a completely new market (Google – internet search in general). The drive to innovate is the hardest to instill in a company, and having someone at the top who clearly has such drive reinforces the concept company-wide.

-

The Front-line obsession

Front-line obsession is with regard to customers. As founders, they had to talk to customers and make deals. They had to be out in the market, looking for opportunity themselves. Professional CEOs come into established businesses without having done a hard time of customer interaction. In the worst-case scenarios, the professional leadership of a company becomes simply a bureaucracy that has little connection to its customer base.

-

Owner mentality

Owner mentality is management thinking of itself as an owner (and hence has a vested interest) rather than simply an actor. This gives management more initiative to execute risky policies. They may also not be as interested in simply maximizing profits but building a name for themselves.

-

Comprehensive knowledge, moral authority, and long-term commitment

The other ideas – comprehensive knowledge, moral authority, and long-term commitment are more self-evident. The founders know the products, customers, and markets inside and out. Regarding moral authority, they built the company and have been at the helm since the beginning, hence they have a stronger voice than outsiders. And finally, they didn’t build the company to fail. Furthermore, they may be more interested in legacy than next quarter’s profits, so they have long-term visions – which usually translates into solid long-term performance.

What does all this mean for investors?

Well, first, we need our founders to take the company public – sometimes they don’t, and in that case, we will have quite a difficult time breaking into it unless we’re venture capitalists. The wealth generated by an IPO is not easily resistible, though, so how should we view founder-CEO-operated companies? When investing, there is more than just the numbers – look at the management.

Founder-CEO companies, past and present

The following are companies that had founders who continued to lead the company once it had become a behemoth. Most of these companies have done well, though we will also look at companies that haven’t done so well, even with founder-CEOs.

Back in the day of MySpace, social media was fractured and not that prominent. Today, social media sparks and fuels revolutions, not to mention its prominence in society itself. Facebook’s founder, Mark Zuckerberg, is still running the company.

Zuckerberg started building desirable software early, with Microsoft offering to buy his MP3 player before he even went to uni. According to Entrepreneur, he started even earlier (e.g. middle school). As for our above criteria, he famously refused to sell Facebook several times, part of the owner mentality – an owner who is sticking around for the long-term.

-

Tesla – the future of cars (and IP?)

Tesla is mostly known for its cars, but they also build solar power systems for the home. Founder and current CEO, Elon Musk, is a serial entrepreneur, having also founded giants PayPal and SpaceX. Musk, a native of South Africa, is driven by his desire to change the world. He wants to build an environmentally sustainable economy so much he released Tesla’s patents for electric vehicles in the hopes that the established auto companies would take electric cars seriously.

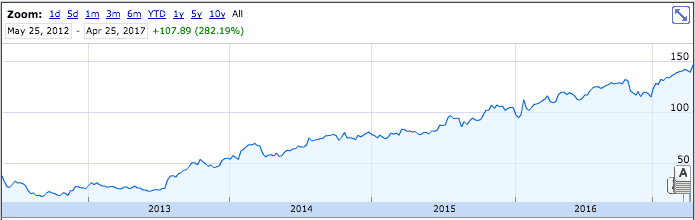

Does releasing your patents indicate a psychotic business leader? Or was it a brilliant plot to increase the affordability of electric vehicles, spearheaded by Tesla, by establishing economies of scale? Only time will tell, but Tesla as a public stock has done well, rising spectacularly in 2013 and having done well since.

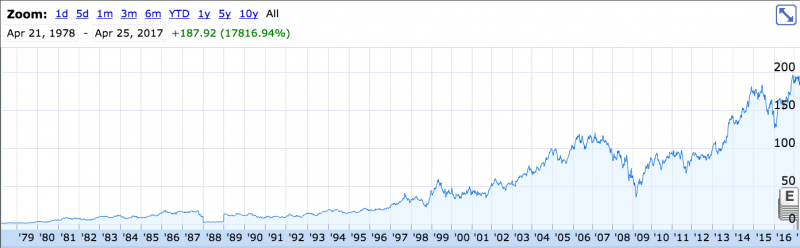

Founded in the mid-90s by Jeff Bezos (who worked at a Wall Street firm prior), this company is stilled headed by Bezos and is the behemoth of retail sales. The company, however, has moved into offering way more than just to customer sales: they offer plenty of services, too, which is one reason Amazon’s name has more pull than eBay.

Bezos was trained as an engineer at university, and he showed an early interest in how things work. He has an interest in personal space travel and has made investments in the field. His drive to build the biggest online store named after the highest volume river in the world has led to Amazon’s current stage.

-

Google (Alphabet)

Google – one of the most powerful companies in the world. Initially simply a search engine, the company offers numerous services and does significant research in traditionally non-tech spaces like automobiles. Their work on AI has yielded interesting results, and they heralded the era of Big Data.

The two co-founders, Larry Page and Sergey Brin, like so many founders on this list, built the company from a garage, and today the company attracts some of the best minds in the world. Staying true to their original idea (to organize the world’s information), Alphabet Inc is involved in countless efforts to apply technology to the real world.

They brought video to the home – first as a DVD-rental service that used snail mail, and eventually as a streaming service with its own proprietary TV shows.

The company was founded by Reed Hastings and Marc Randolph, with Hastings currently acting as CEO. According to CNBC, one of Hasting’s tips is to not limit the company and think about what may come – for this reason, he didn’t name the service “DVDs-by-Mail”, which is good, because their business revolves around streaming now.

NVIDIA recently had a nice boost because GPUs are becoming ever more popular for parallel processing, something that itself has become more important as huge mountains of data build up and the same simple calculations are required on many data points. In fact, we already wrote about GPU opportunities before.

Jensen Huang, one of the co-founders of the company, is still the president and CEO (after over 20 years). HBR ranked Huang as the 6th best performing CEO in 2016, and the article praises long-term commitment before presenting the list. With GPU computing rising, the company is moving into the AI space instead of continuing its march solely in computer graphics. Does Huang’s continued presence have anything to do with that?

Our first non-tech company, Starbucks is almost synonymous with coffee in the United States. There are almost no competitors there, though globally, the company faces much more competition. The company is operated by Howard Schultz, who has appeared numerous times in the media championing social causes. According to Starbucks’ website, he grew up in public housing, which may be one reason he fights for so many social changes. He has an entrepreneurial spirit, which leads him to focus on innovation and helping others better themselves.

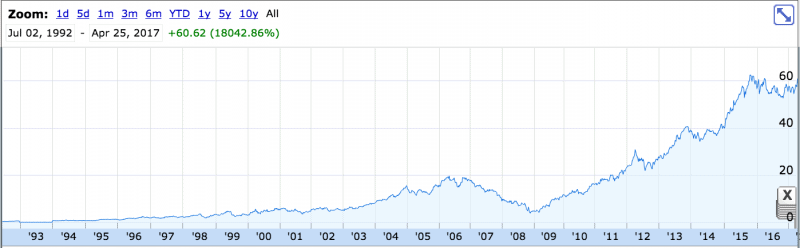

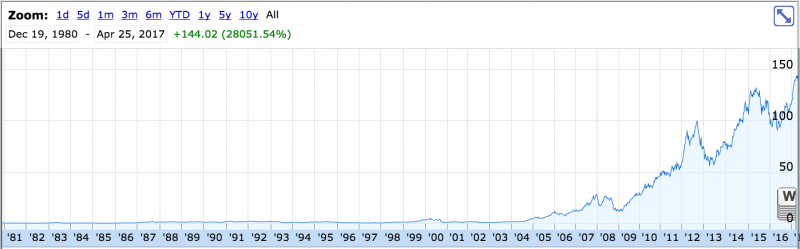

His leadership style and business knack has since translated into strong returns for investors since its IPO in 1992. With so much focus on social issues today, it is no wonder Starbucks continues to be viewed as a reliable and likeable company.

How could we forget FedEx, one of the logistics companies behind the rise of home internet shopping? The company is still run by Frederick Smith, who served two tours in Vietnam, surviving an ambush. According to Forbes, he also took a huge risk when he went to Las Vegas and played blackjack while the company was failing – he sent the $27,000 in winnings back to the company, displaying a true “owner mentality”.

A clothing company that does not have the founder’s or designer’s name stamped onto everything. The founder is Kevin Plank, who used to play collegiate football, and he has spent plenty of time looking for customers. During the company’s initial stages, he was usually on the road, pitching his product in locker rooms across the US. He stereotypically sold the shirts from the “trunk of his car”. This entrepreneurial spirit influences UA even today, with Idea House, a platform to help entrepreneurs succeed.

Founders who Leave – The Two Giants of OS

Apple was co-founded by Steve Jobs, Steve Wozniak, and Ronald Wayne in the 1970s. Wozniak and Wayne left relatively early, and Jobs left in the mid-80s. The company battled IBM and Microsoft, and when Jobs’ second company, NeXT, was acquired by Apple, and he returned. In 1997, the company was coming close to bankruptcy, but upon Jobs returns, the company simplifies, launching the iMac and eventually becoming the company we know today.

Did Jobs and Wozniak leaving cause problems? There are too many confounding variables to say for certain, but upon Jobs’ return, the company’s fortunes started to look up. Of course, after his death, the company continues to do well.

The great rival to the Mac OS, Microsoft also began in the mid-1970s. Bill Gates and Paul Allen founded the company, and Gates served as leader until 2000, when he became the Chief Software Architect. Although Gates gave up the executive position, he still continued to influence the company. The company has since diversified into several service areas, though their attempt at moving into the mobile space has proven difficult. Apple and Android OSes are much more dominant in mobile.

The Founder-CEO combination is not a godsend

Twitter is still headed by its founder, Jack Dorsey. The company’s history features a meteoric rise, and the company certainly generates huge mounds of data every day. There have been significant changes of leadership since the company’s founding in 2006, and this may be a source of the financial problems Twitter faces.

Dorsey’s return saw 8% of the staff fired and Dorsey pledging his own shares (about a third) to the remaining employees. Whether this pays off, we will see. He has been back since 2015. The share price has been relatively steady since his return, but it is still far below its IPO and subsequent trading prices.

Companies to watch out for

Obviously, not all founders can be CEOs, but the ones who are CEOs tend to do a good job with running the company. Maybe they have a more personal connection, maybe it has to do with their personality in the first place (they are entrepreneurs), or maybe it is something else. Either way, below are a few stocks that are still founder-run, and they may or may not be the future Amazons or Googles.

- Hubspot – both co-founders (Brian Halligan and Dharmesh Shah) are still at the company, which is another tech company that makes tools for social media marketing, SEO, and content management. The company IPO’ed recently and has nearly doubled its price since (though early 2016 saw a big dip).

- SnapChat – messaging service whose main feature is impermanence. The two founders are CEO and CTO, and the company has renamed itself Snap Inc. They hold about 70% of the voting power together, though they own about 45% of the shares. The company is up from its IPO price of $17 (to the initial investors), but down over 20% from its euphoric high.

- Twilio – Twilio allows programmers to make automated calls and texts; unlike many popular services today, this one does not rely on advert revenue but usage billing. The company is sitting around its IPO price (June 2016), after a rapid rise and decline. It has been relatively flat since November 2016.

- Blackline – a finance and accounting firm based in the cloud, this company has been around since 2001. It provides services to 1,600 companies, including big names like Under Armour and Sirius XM. It went public in October 2016 and has risen steadily since. This is a rare firm on this list, as the founder and CEO is female.

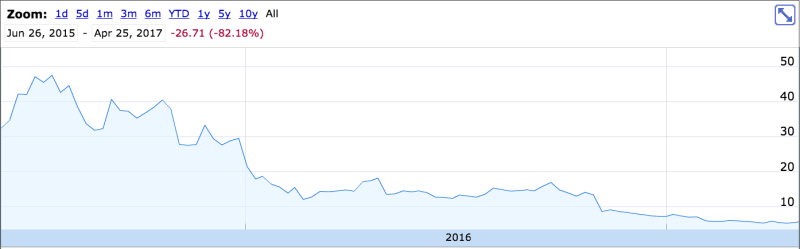

- FitBit – the wearables space has been hot recently, and staying in shape has never been more socially encouraged. FitBit is trying to capitalize on both trends by providing wearable tech that tracks fitness. The company IPO’ed in June 2015 in the mid-30s, but it recently closed under $6. The stock lost most of its value by February 2016 and has fallen more, but it has been a flatter curve. The two founders are still there, so put this one on your watch list – you might want to pick it up on the cheap.

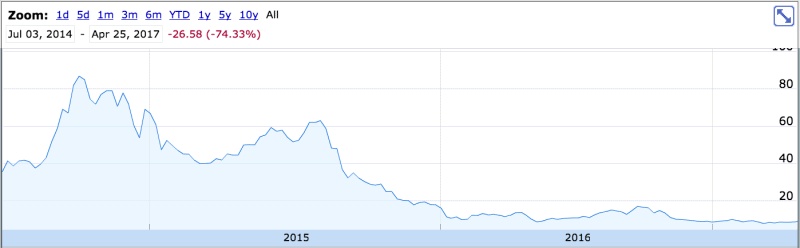

- GoPro – the company is famous for bringing great images of extreme sports and just about anything else you can film with a small camera attached to… anything. With the explosion of VR and AR in the coming years, GoPro may be in a great market. While it was founded in 2002, the company went public in mid-2014, with the usual initial spike and decline. It has been sitting at about one-third its initial price since January 2016, so this is another possible cheap pickup. Keep an eye on any news about home-filmed VR apps, because GoPro would be well-positioned for such a development.

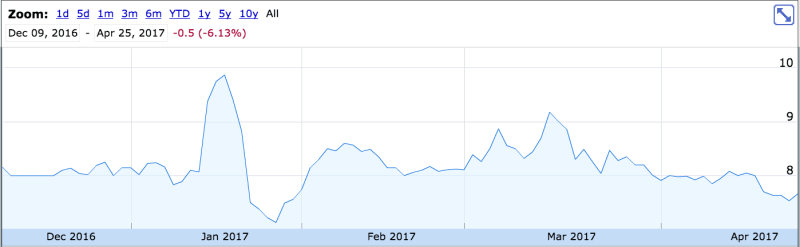

- Trivago – is a hotel and accommodation search company that IPO’ed in December 2016 on the NASDAQ. The company is up almost 30% since, though it hasn’t been too long since the IPO. Expedia is the largest shareholder, but the founders are still the key people. The company generates revenue from hotelier subscriptions for increased control and from a per-click revenue model.

- SenesTech – the company IPO’ed back in December 2016, and other than a small spike at the beginning of this year, it has been flat, though it is currently below its IPO price. The company is a biotech company that specializes in rodent control with a twist. Their feature product does not kill the rats outright; it destroys their ability to reproduce. The would-be rat parents die of natural causes in a few months, leaving behind no children to contribute to your rodent problem. This is another female-led company.

- Crispr Therapeutics – another biotech, this one is more science fiction-y… until you realise gene editing is now real. The company aims to cure serious diseases via gene-based medicine. The company went public on the NASDAQ in October 2016 and isn’t trading much above its IPO price. Only one of the co-founders is still around, but he is CEO and a medical doctor.

- Nutanix – since its IPO in September 2016, the stock price has steadily declined to only about 33% of its IPO price. The company deals in cloud computing and storage so the customers do not have to deal with data center infrastructure. Whether they can turn around their finances is uncertain and needs to be seen.

Possible Near-Future IPOs

- Houzz – the company has been a hot topic for an IPO over the last year and a half or so. It is still currently a private company, founded in 2009, but the founder is also still the CEO. The company runs a website for home improvement, architecture, landscaping, and interior design. They make their money from the marketplace, which collects commissions on peer-to-peer sales, and from subscriptions for professionals (such as interior decorators) who want to increase their visibility.

- Airbnb – another company that is still private, an IPO may be in the near future. The company allows homeowners (or renters) to rent out a portion of their property for short- to medium-term stays. It is part of the new “sharing economy” (with the likes of Uber) and operates in plenty of countries. The company takes a commission from each property rented through its website, which has afforded it a lot of cash.

- Uber – still private, watch out for this company to go public soon. There has been some recent controversy, but overall, the ride-sharing service has embedded itself in cities across the world. The company is still controlled by its founder, though he has had some mishaps recently. As long as their legal and PR battles go well, expect an IPO in the next year or two.

Summary

Entrepreneurial endeavors require a certain skill set and personality traits. When those traits are applied to running a large company, often they are still successful. One reason may be the risk-taking attitude and an interest in long-term product development. A company that has a founder as its CEO, even years after the IPO, is not guaranteed to be a top performer, but many have been.

When investing, one should use as much information as possible to evaluate companies and make decisions. Many investors want to rely solely on the numbers, but you have to note that companies are organizations made up of people, too. Look at management and make sure to think about whether the leadership was there from the beginning or if it is an outsider. Outsiders are not inherently bad, as founders are not inherently good, but all things equal, it may just pay off to go with the founder-led company.

You can track personalised news for all the companies on our award-winning platform CityFALCON here.

Leave a Reply