Disclosure: I’m an investor in Seedrs, and CityFALCON has business relationships with Seedrs.

If you depend on the media you may not realise this but fundraising at an early stage remains a real challenge in the UK unless you have a strong network or have gained early traction. At the same time we’ve realised that the people that are most likely to back you are the ones whose problems you’re solving. We chose crowdfunding 1) to allow our users to also become investors, 2) as a tool for marketing and PR, 3) because a platform such as Seedrs allows us to accept small cheques, and 4) mostly because most European VCs that claim to invest at the seed stage are more risk averse than my late granny.

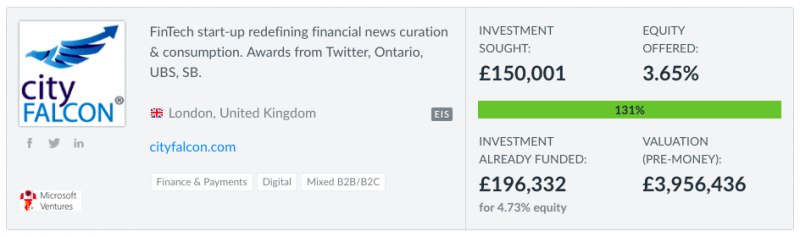

Our campaign on Seedrs is still live, and luckily we are way above our minimum target. When the campaign closes, and we have the money in my bank account, I can add one more badge to my accomplishments as a first time entrepreneur. After this round, we would have raised more than £600K from angel investors, family and friends with no VC money i.e clean cap table with no fancy terms.

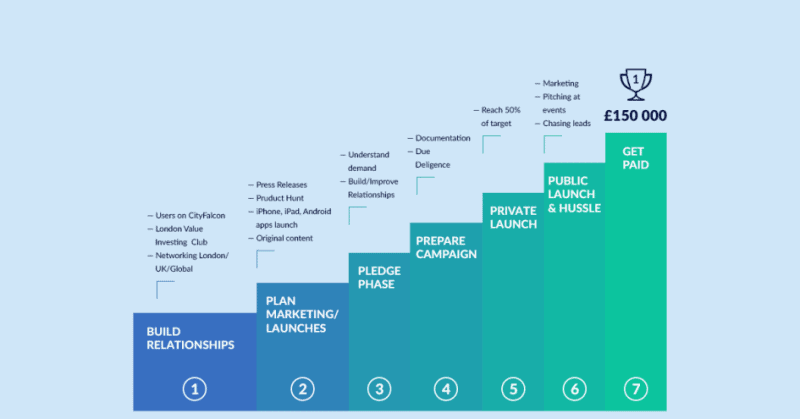

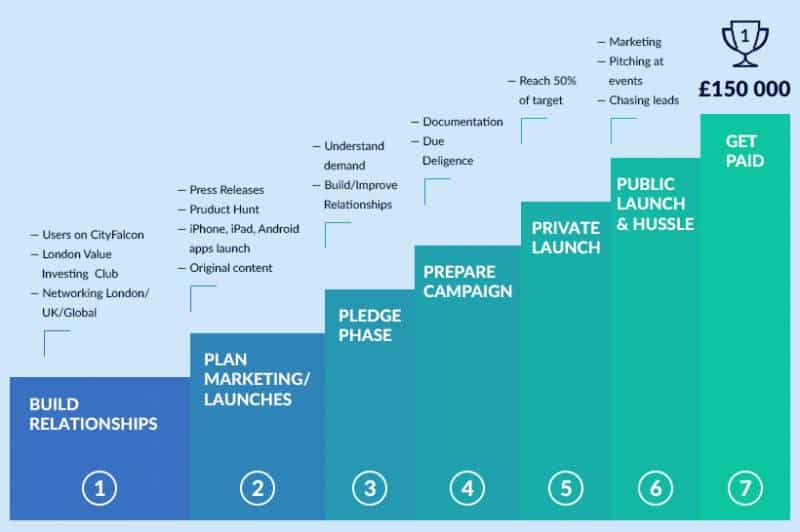

OVERALL VIEW

To be completely honest, fundraising is one of the most boring, stressful, and at times, a time-wasting thing you have to indulge in as an entrepreneur. A crowdfunding campaign entails cumbersome but required due diligence, FCA rules, expectations management and interaction with tens to hundreds of small investors. As the sole founder, the last two months have been quite demanding for me, as I went through the rigours of fundraising while tackling the ongoing challenges of running my business. However, when the progress bar reached £150K, I can’t express how happy, satisfied and relieved I was – all the effort was worth it, after all.

THE CROWDFUNDING PROCESS

While the headline in the media may read something like ‘another FinTech company in London smashing their funding raising goal in a few days’ or ‘there is a lot of money available for start-ups in London’, our campaign required a lot of planning and execution. Also, we were lucky with several things working our way during the campaign.

Phase 1: Build Relationships

Running a company is like a Chess game, and while you have to plan for at least 3 moves in advance, you have to also adapt to changing circumstances and business environment. We have been planning for this crowdfunding campaign for more than a year now and were waiting for our product to be a little more mature and also gain some early traction. With a lot of focus in the UK on revenue traction and less appreciation for burning cash to build scalable products, we had to make sure we had enough to excite potential investors.

We launched London Value Investing Club last year and now have more than 1000 members; some of these people have become our brand ambassadors and investors in the business. Also, we communicate regularly with CityFALCON users and several of these users have joined our Seedrs campaign.

As an introvert, I’d rather spend time reading a book or watching a movie, but now as an entrepreneur running a business, I have to be out and about to grow my network and find like-minded people who could support us in our efforts, as we seek growth through funding or business leads. Interestingly, our investors include two of my former / current Salsa friends, someone I met at a wedding in Bulgaria and some other people who I met at random dinner events.

Phase 2: Plan Marketing and Product Launches

Even if potential investors get excited with your campaign, they may still not push the ‘invest’ button. You have to keep them interested and excited by feeding them with regular positive news. We do not believe in ‘playing a game’ with investors but instead work much harder to prove to investors that we are a worthwhile company to invest in.

We had been planning our marketing campaigns and product launches to coincide with the Seedrs campaign, and we got most of these out in time:

- Getting featured on Product Hunt homepage.

- Launching our iOS and Android apps.

- Getting featured in Huffington Post.

Also, luckily we had a couple of other things happen that made our campaign stronger:

- We got accepted in the Octopus Labs accelerator with a possibility of Octopus Investments investing or ‘spinning in’ at the end of the programme in January 2017.

- Our trademark application for ‘CityFALCON’ in the UK got approved. It’s nice to see the ‘R’ next to our logo

Phase 3: Pledge Phase

Several companies that have raised money through crowdfunding in the past created a landing page on their website to garner early interest in the campaign. I suggest every business to do this but to be careful not to get carried away by the pledges. We had more than £500K in pledges, but most of these people either did not invest or invested only a fraction of what they had originally pledged. In fact, the most annoying part of this process was when suppliers, job seekers and fund seeking entrepreneurs used this as a way to get in touch with me. I’ve wasted several hours meeting with people who had no intention of investing in the campaign. I’m all for helping other entrepreneurs, but this method is not ideal.

The important thing to consider during this process is that there are less restrictions on what you can do compared to when the campaign goes live on Seedrs; mainly because of the FCA guidelines. This phase allows you to test the waters and get the pulse of the target market before going live with your campaign. Also, this would be your last chance to understand if there are any users/connections from outside the EU who’d like to invest in the campaign. Once the campaign goes live, you are not allowed to have a landing page on your site to collect details, and if you drive international audience to the Seedrs page, they’ll see a message saying they can’t invest because of being outside of the EU. Also, unfortunately, we can’t take money from possibly one of the countries with the most risk-taking people in the world – the US.

Phase 4: Prepare campaign

This stage can be quite time consuming and frustrating at times, but is essential for maintaining the transparency and accuracy of your campaign. We drafted and submitted all the content of the campaign, and then worked with Seedrs on due diligence. There were some things that we couldn’t prove and so we had to remove them from the campaign. Also, it was frustrating that our top institutional client didn’t allow us to add their name as a client in the campaign.

We wanted our crowdfunding campaign to be one of the most transparent campaigns ever, and thankfully we succeeded. We published a series of articles to better educate our potential investors:

- Why We Are Valuing CityFALCON’s Crowdfunding Round at £4m?

- Why You Should NOT Invest In Our Upcoming Equity Crowdfunding Round

- Our Commitment to Investors in Our Crowdfunding Round

One of the key things for the campaign was also to have a good video to get investors interested. We didn’t want to have just another boring video with people speaking in front of the camera, and so as risk takers who are not worried to fail, we tried something different with our video. It was all shot on mobile phones, and the total cost including equipment, editing, etc. was less than £200.

Phase 5: Private Launch

This is one of the most critical stages of your campaign. Many believe that you can put up your campaign on a crowdfunding platform and the crowd will start pouring in the money. Unfortunately, several campaigns even with good ideas and execution fail. Most investors want to see other investors put money before they put their own creating a catch-22. To solve this problem, I started with £5K from my own pocket even though I don’t get any EIS benefits (yes, wtf!). We got our existing investors, people from our network, and from London Value Investing Club who trusted us to get the campaign started. We reached 50% of the target in over a week and half, which gave me some confidence to make the campaign public.

Phase 6: Public Launch & Hustle

With all the hard work done to get to that stage, I was expecting it to be a smooth ride to reach the target, but when we went public, we showed up on the third page of Seedrs. It was a moment of panic, and I reached out to the Seedrs team to understand why we would not be on the first page of Seedrs as a new campaign. The issue was that by default Seedrs sorts the campaigns based on how ‘trending’ they are i.e. the bigger campaigns in terms of money raised, % raised, or number of investors stay at the top. As an investor in Seedrs and as an entrepreneur, this is the biggest criticism of Seedrs – you need to give a fair chance to new campaigns!

We realised very early that we’ll have to work really hard to reach our target, and so had to start hustling – emails, phone calls, Linkedin. Several people requested for investment documents, had conversations with me on the phone, WhatsApp, email and in person, and only a small % actually invested. During this process, we found some ‘real’ angels who supported us and got us over the line. These are the people I’ll be indebted to for life, because without them, we would have struggled to reach our target!

Phase 7: Get Paid

Even on Seedrs, if you see that someone has invested, it doesn’t necessarily mean that they have actually invested. Also, most people can cancel the investment whenever they want until the campaign closes. So we are right now in the stage of getting people to pay the amounts they pledged to Seedrs, and luckily we haven’t seen much loss in this process. It’s not over till it’s over!

LUCK & TIMING

One of the biggest learnings as a first time entrepreneur is that you need lady luck to give you blessings for you to succeed. We did work hard for this campaign, but I can’t deny that luck and timing were in our favour without which things would have been tougher. Interestingly, Seedrs had the one of the best months ever in October 2016 which meant that there were more potential investors been driven to the site, and hence, more eyeballs for your campaign.

THE GREAT, GOOD, BAD, & UGLY OF EQUITY CROWDFUNDING

The Great

- With unfortunately not much funding support for start-ups at an early stage or even pre-Series A stage, I truly believe that equity crowdfunding is one of the best things to have happened to the start-up ecosystem. Without it, we at CityFALCON would have suffered.

- More than 150 people invested in our campaign, and as for us, and most of your investors will also be your brand ambassadors and provide you product feedback.

The Good

- The marketing and press coverage definitely helps.

The Bad

- Most entrepreneurs are misguided by the media and ‘smart’ advisors, and don’t necessarily understand how crowdfunding works. I’m hoping that this post will help.

- FCA guidelines are really strict, and makes it difficult for start-ups to effectively market the campaign. Without marketing, entrepreneurs have to rely just on the network that the equity crowdfunding platform brings which is very limited.

The Ugly

- You have to share your strategy in a public forum.

MY WISHLIST FOR SEEDRS AS AN ENTREPRENEUR AND INVESTOR

Our experience of working with Seedrs has been great – we received a lot of support from the team, the platform works really well, and I look forward to doing a follow-on campaign with them in the future. However, here are some my recommendations, based on my experience of being a Seedrs investor and entrepreneur:

- Please launch in the US quickly, and allow international investors to easily invest in campaigns. I understand the regulatory requirements can be onerous, but if there is any company that can do it, it’s yours!

- Work with FCA to be less restrictive when it comes to marketing, especially to investors who can claim SEIS and EIS benefits.

- Provide some more exposure to newly launched campaigns on the site; having ‘trending’ as the default sorting criteria fuels the herd-mentality in investors, provides more support to bigger companies and is unfair to early stage companies with a limited network.

- Provide a clarification on how you decide which campaigns on the site to promote on social media, through emails for ‘early access’, which companies are invited to pitching events, etc. Unfortunately, what I see is that bigger, more popular campaigns usually get more promotional support from Seedrs.

- Product requests:

- Show names of ‘anonymous’ investors to the entrepreneur. We get to see them at the end, but it will help a lot during the process and it will help us to know who not to chase for investment.

- Have a section to show new investments and cancellations to entrepreneur. Otherwise, we have go through 150 investors to figure out where the additional investment came from.

- Add a section in the campaign for ‘what could go wrong’ or risks along with steps that the company is taking to mitigate those risks.

- It’s time to stop the requirement for separate pitch decks. All the data is available in the Seedrs campaign, and it’s an extra burden to maintain another pitch deck. However, I agree that financial forecasts for competitive reasons should only be shared with a limited audience.

- A way to interact with the Seedrs team directly from the platform instead of through emails.

We’ve learned a lot during this process, and happy to answer any questions from fellow entrepreneurs or anyone else who might be interested in knowing more about this process. Keep innovating, hustling, and changing lives!

Leave a Reply