Disclaimer: This is a guest post from Michael, and does not reflect the views of CityFALCON and its stakeholders.

L.B. Foster Co (NASDAQ:FSTR)

Date: 10/11/2016

Price: $12

Valuation: Easily $25

Business overview:

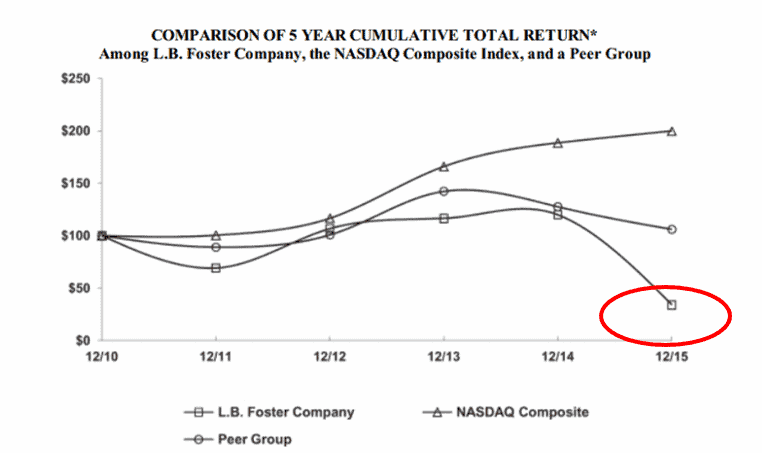

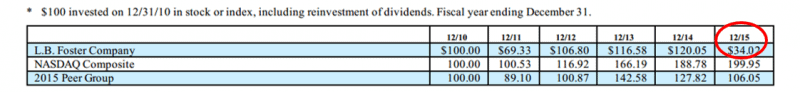

FSTR is a manufacturer of products for rail, transportation, construction, energy. Its share price has crashed since 2015.

No single customer accounted for more than 10% of the company’s net sales in the last few years, this makes the company’s operations more resilient, and future revenue stream will be more diversified and less volatile. These will, in time, combine to demand a higher multiple to be assigned to earnings.

Operating Segments Overview:

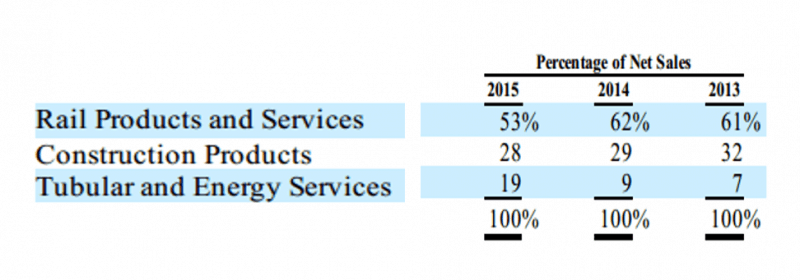

FSTR is fairly well diversified:

Rail Products and Services (~50% of revenue):

Rail Distribution sells new rail, mainly to passenger and shortline freight railroads, industrial companies, and rail contractors for the replacement of existing lines or expansion of new lines. Although the coal industry has had a terrible two years, there are some green shoots starting to be seen in the US. And while it is way too early to start talking about recovery, I believe that this sector has hit the bottom and upstream service companies such as FSTR that have suffered from a lack rail maintenance and expense will over the next 12-18 months be beneficiaries of this recovery, when it finally arrives.

Construction Products (~30% of revenue):

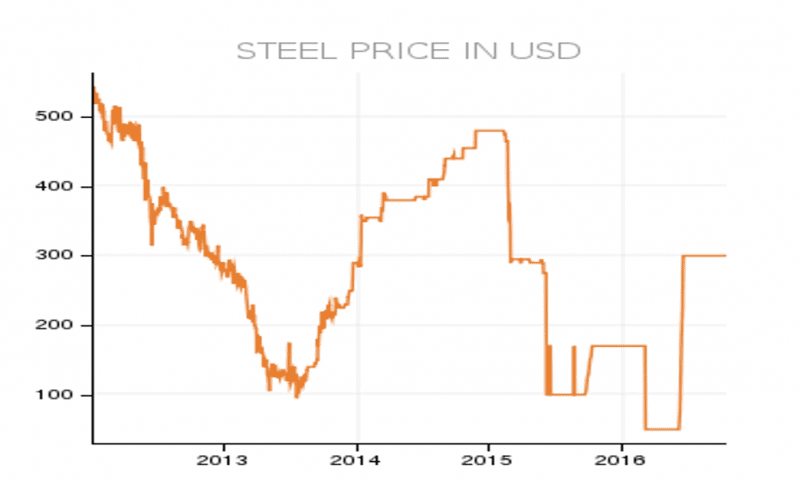

This segment is made up of sheet piling products. These are interlocking structural steel sections that are generally used to provide lateral support at construction sites (see photo below). This segment of the business is currently suffering from the crash in the oversupply of steel, causing the price to plummet in the back end of 2015 and into 2016 (see graph below):

Tubular and Energy Services (difficult to say the % of revenue here, because it had been growing through acquisitions, but this segment, in my opinion, is too unstable and young to say with certainty. Mathematically, to bring it to 100% I will say ~20%):

In the last quarter they had to take impairments to the acquired businesses (mostly Inspection Oilfield Services, Inc. (“IOS”)). More on these non-cash impairments charges below.

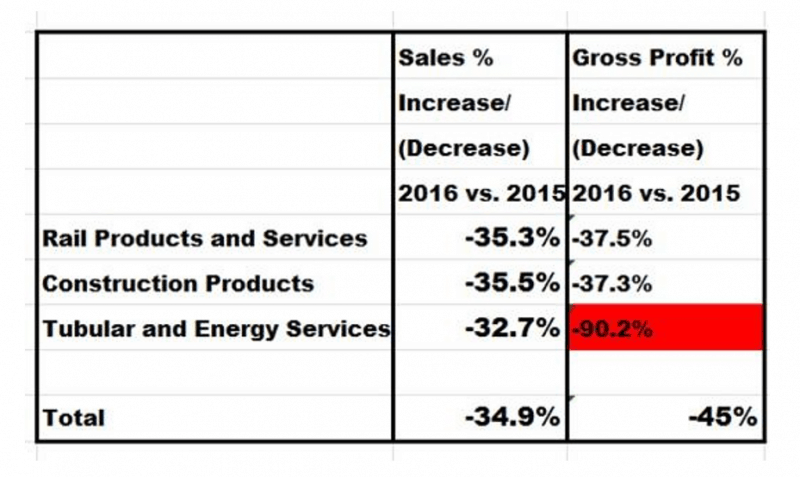

Further Detail Into FSTR’s Operating Segments:

Although FSTR has three operating segments, the bulk of its revenue comes from two segments. But it is the third and smallest segment, Tubular and Energy Services that has caused most of the “noise” in the 9 months to date of 2016.

Rail Products and Services (~50% of revenue):

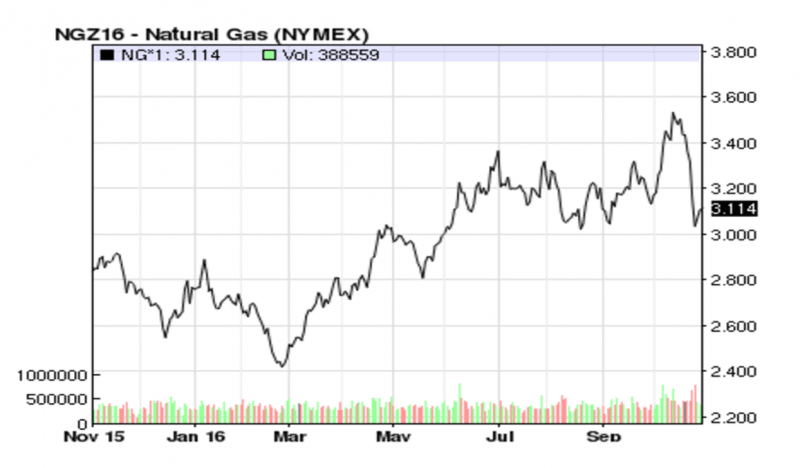

North America freight rail market continues to have troubles. I am quite familiar with the coal industry and significantly profited from my Cloud Peak Energy (CLD). It was a very long and convoluted thesis, but short thesis was that the coal industry was not dead, that there would not be as much coal being dug up and exported as historically, but once natural gas crossed $2.50, coal would once again be bought up electric power plants in the US. Currently natural gas trades for ~$3.11 and as you can see in the graph below investors feel very confident paying up for CLD’s future earning stream. (By the way, I pitched CLD at Ruzbeh’s Value Investor Club on the 7th of July 2016.)

So while commodities, such as coal and petroleum have apparently hit the bottom of the cycle, companies such as FSTR (and others involved with commodity freight) will benefit from the turnaround in the energy market:

“…coal led the way with the commodity car loads, coal declining 27% and not far behind it was petroleum products which declined 22%”.

From FSTR’s Q2 2016 transcript.

“So we anticipate that there will be continued restructuring by all freight rail road carriers, we do not anticipate coal volume returning to prior year levels, given the transition that’s underway toward natural gas…”

From FSTR’s Q2 2016 transcript.

But the irony is, at the time of the transcript that was 100% accurate, but natural gas prices have rocketed since then.

Construction Products (~30%):

“Our piling business continues to be impacted by depressed steel prices that are affecting both our top line revenue and our ability to secure business.”

From FSTR’s Q2 2016 transcript.

The construction products operating segment accounts for ~30% of total revenue. Recently, steel prices have started to turn around, or at least, hit the bottom of the cycle, see graph below. However, investors are not even considering that this segment will ever be profitable again, leaving considerable money on the table.

However, as you can see in the spike in the middle of 2016, I think that the price looks to have recovered a little. One could argue that its too early to know for certain, but as thing stands, at the current price we can pick up FSTR, it appears that the Street has left this segment for dead.

The Wall Street Journal recently reports: “China Steel Exports Fall for Second Month in a Row, Trend likely to be welcomed by global rivals who have complained about a supply glut”, demonstrating that steel, being a cyclical commodity will, in time, recover.

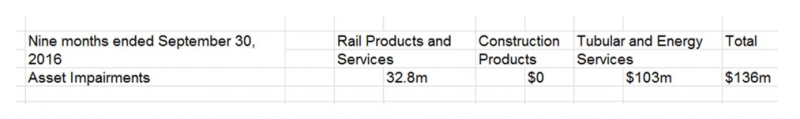

Impairment charges:

The reason that this company is selling at a distressed price is because of its non-cash impairment charges and the lack of visibility. FSTR has had to take non-cash impairment charges to its balance sheet, for companies it overpaid for in 2015, when it mis-timed the bottom of the energy cycle. FSTR’s management thought they were getting a bargain, but in hindsight, they were proved wrong. So $103m worth of impairments were charged to the income statement for a segment (Tubular and Energy Services ) that generates only about $34m worth of revenue (or 20% of total revenue). I can definitely live with this.

Financial position:

Take your time to look at the financials.

The items worth paying attention to are:

- Profitability, stability, FCF, dividend

- FSTR is always profitable apart from right now

- FSTR is very stable and growing, not volatile.

- Very high Free Cash Flow Margin (FCF/revenue of 6.1%)

- Dividend is growing

- Current ratio of 2.2x

- Total number of outstanding shares is very stable

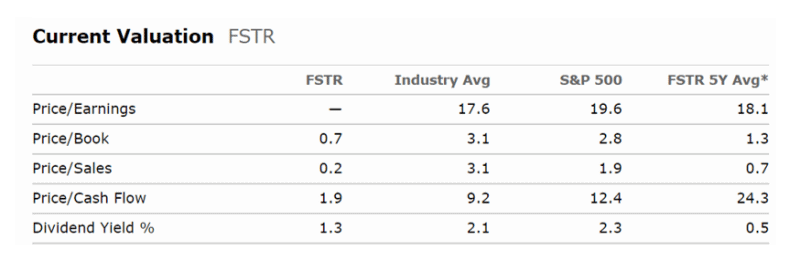

Valuation:

Investors were quite happy to pay 0.7 P/S for this very capital intensive business over the last 5 years, and get 0.5% dividend. Now, investors will only pay 0.2 on a P/S. FSTR is selling at a very much distressed price. Investors are not seeing the bargain that is available.

Competition:

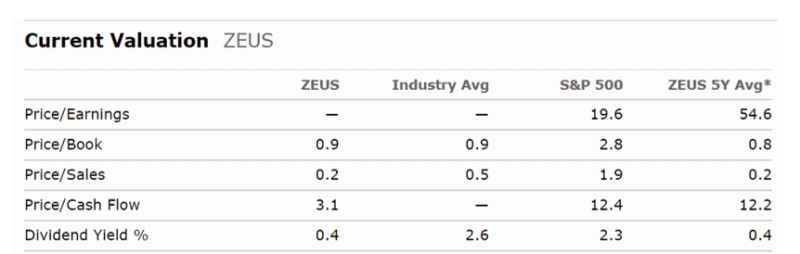

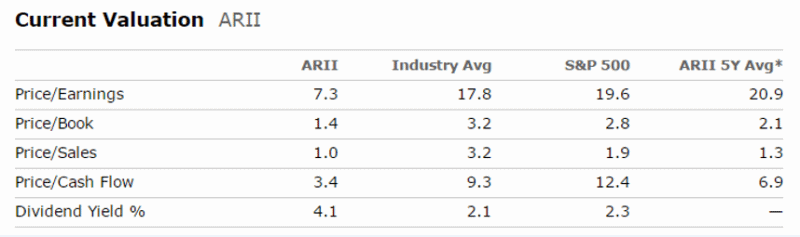

Olympic Steel (ticker ZEUS); American Railcar Industries Inc (ticker ARII). As you can see from the relative tables below, both these companies are more or less trading for fair value.

13D (investors should recognise this SEC filing and get a warm feeling inside, but if you don’t remember, this filing means shareholder activism):

The activists have got on a seat on the Board. And they have continued to purchases shares in the open market and spent roughly $3m acquiring about ~12% of FSTR’s stock.

Conclusion:

I am undeterred by the lack of visibility in the underlying operational business, exacerbated by the current volatility in the commodity cycle. Are you like me in this sense? Do you have a firm believe that the market price is there to serve you? FSTR is a simple and relatively stable business with temporary problems. What attracted me to FSTR was its high free cash flow generation capabilities, one of my core value investment principles. The fact that FSTR is growing revenues as well as being much better positioned, and being even more profitable in 2-3 years is icing on the cake. It is difficult to tell for certain when this investment will turn around, but I am being more than well compensated for this uncertainty. At the price it currently trades for (~ $12) my downside is very well protected.

If you’d like to track real-time relevant financial news for L.B. Foster Co (NASDAQ:FSTR), check it out here.

Leave a Reply