In this Age of the Algorithm and Big Data, everyone is vacuuming up as much data as possible in the belief that more data implies better results. The idea is that the more data we collect and analyse, the clearer the picture becomes. In traditional business and finance settings, this often meant numbers about the money and only the money. Some other key numbers, like customer turnover and traction, were also used. One important aspect of this data was that it came from sources internal to the reporting company, mostly in the form of financial statements to regulators and PR releases to investors and the public. Traditionally, mainstream media was the only other source of information about companies, which was dependent on journalistic integrity.

But now, as we race to quantify everything, there is a set of data that used to be overlooked that can provide insights into situations as well. This is alternative data, which can either be sourced from inside the reporting company or from third parties, the latter commonly being considered impartial and more trustworthy. It comes in much more diverse forms than financial information, like customer satisfaction ratings, sensors from the factory floor, and financial transactions between parties (not just internally).

Some of these data sets, like factory data, are unlikely to be released to the public and are used mostly for internal optimisation or potentially for auditors to estimate and verify reported numbers. Other data sets, however, like customer satisfaction ratings, especially when aggregated by third parties, are often made public and, perhaps more importantly, cannot be controlled by the company that is the target of the reporting.

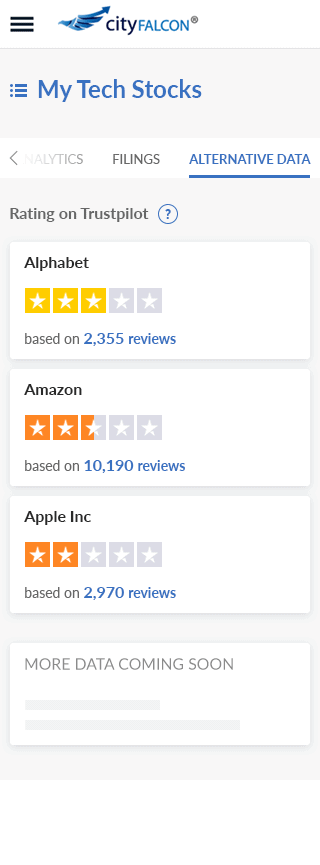

As part of the Big Data and AI revolution in financial content, we at CityFALCON are acutely aware of the role that data plays in investment, and for that reason, we are incorporating Trustpilot data into our platform to serve customer satisfaction ratings to our users. In this post, we’ll expound on alternative data, why it is useful, and how we are once again pioneering a one-stop-shop due diligence platform with alternative data from Trustpilot and other sources.

Definition and Importance of Alternative Data

Alternative data is any data that was not traditionally collected or published by companies. This could be because it was not seen as valuable or because the infrastructure simply did not exist for its collection. In 1980, there was no World Wide Web to collect site usage statistics about, and the Internet of Things only started proliferating and producing its flood of data in the last decade or so. IoT sensors on consumer products have become more popular with “smart” devices like refrigerators and TVs, bringing these sensors into every corner of daily life.

Externally and for companies, customer satisfaction ratings, website traffic data, search engine result ranking, and product reviews are common datapoints for analysis. Product reviews are often not single numbers but textual information, which can then itself be analysed. Social media output and scraped “whispers” from forums are two other sources of textual data that can be considered for alternative data analysis.

However, this is the era of Big Data, and humans simply cannot understand the data sets in their entirety. Thus single numbers are often generated, such as an average of all customer ratings or a frequency of mentions in a certain timeframe. Textual information can be analysed for sentiment, spam probability, and relevance to specific viewers, too.

So why is this important? Lost data is lost information, and lost information can be lost investment and business opportunity. As markets become more efficient – ironically due to more data – the search for alpha becomes more difficult and alternative sources of data are required for investors to achieve better returns. And since big market players like hedge funds and the trading desks at banks are starting to use alternative data as input to their mathematical models, the markets will start to incorporate alternative data into stock prices simply due to its widespread use. Because these big data sets are impossible for any individual to understand, retail market participants who have no data science or mathematical modelling experience must rely on external sources or risk being left in the dark about some aspects of their investments. This is a more pressing issue for traders than investors since price movements need to be captured for profit, but even investors who ignore alternative data can miss important signals, either missing out on upside or suffering downside as knowable but overlooked risks materialise.

Fortunately for retail users, CityFALCON offers an affordable alternative data solution.

The Alternative Data Tracked and Offered by CityFALCON

To date, our main source of alternative data has been the content of and analytics on social media posts (through Twitter). Twitter serves as an early message broadcast system for executives, companies, and news organisations, and it qualifies as a textual source of alternative data. A breaking news story can rapidly spread through Twitter before it appears on any traditional media platform, making the source important for those who wish to capture price movements.

Our proprietary CityFALCON score can also be seen as a type of alternative data provided by a third party. This personal relevance score allows users to skip low-relevance stories and focus their research efforts on the information that matters most. This affords our users an edge over market participants that are blindly slashing through the jungle of media available to them, adding one more layer of information that can be used to conquer markets. Because we calculate the score internally, it is not biased by external influences and therefore can bring the user closer to the true situation of the target, whether that be a sector, a stock, or any of the 250k+ other topics in our database.

Our Trending Stories is another kind of alternative data, wherein we are monitoring the frequency of certain topics and can provide users with a quantitative look at how much more popular a topic has become over a certain timeframe. This analytic can then be spun into investment and trading opportunity, while 25 years ago this type of data simply did not exist in real-time.

The Newest Alternative Data Addition – Trustpilot

Another source of alternative data is customer reviews, and we have partnered with Trustpilot to bring customer review scores for companies to our users. Any company on CityFALCON that also has Trustpilot content will automatically have the score displayed. In the first half of 2020, we expect to also provide more content than just scores for covered companies.

Trustpilot aggregates customer reviews and ratings for companies and provides that information to anyone on the internet. Since the platform is public, companies cannot control what is written about them, and this adds a layer of trust that is absent from company-provided statements. Trustpilot boasts over 71 million reviews on 320,000 websites, making them one of the top review sites in the world.

Why are customer reviews useful information for a trader or investor in public and private companies? They give some information about the company that is not controlled by the company’s marketing or PR teams, and – for the most part, barring bots and paid reviewers – the reviews are from real people using the product. Sometimes a company’s internal teams may not even intend to deceive, but because the product or service has not yet been released to the public, they overlook some aspect that will impact customer adoption or satisfaction. Once the reviews from real customers start to come in, the true market demand and expectations will be known.

This is particularly useful for smaller public companies and private companies, for which media and other coverage may be scarce. Caveat emptor – buyer beware – applies to investments, too, and trusting the source of the product or service to disclose information, especially negative information, introduces a conflict of interest that must be solved with third parties, like customers, for impartial data.

While not always the case, a lack of reviews could point to a lack of users, too. It is not advisable to simply disregard any company that lacks reviews, but it could signal more due diligence is needed. Companies that mostly do business in B2B and B2B2C channels may lack reviews because they mainly work in the background.

For private companies that are fundraising, there are some common tricks that count “users” in creative ways – this can be positively validated with customer review data. If none exists, a smart investor would ask, in a non-adversarial way, that the company provide more information on what constitutes a “user”.

For investors in start-ups, another interesting use case of customer reviews is how the company handles customer complaints and negative feedback. If the company responds well and satisfies the customer, ideally offering a fix in the next iteration of the product or service, then the investor can be more at-ease with how the company will treat investors, too. On the other hand, if the company is combative to reasonable customer complaints, that can be a very bad sign for investors and future revenue streams.

There are non-investing business uses for Trustpilot data, too. Strategy and product teams can track competitors and their performance for a little extra edge in knowledge management. Entrepreneurial types may even think of new products or services to alleviate pain points that emerge from reviews, especially when customer complaints fall on the deaf ears of incumbents who are slow to react.

You can probably think of plenty of other use case scenarios. If you want, add them in the comments. Or keep them to yourself as a sort of secret weapon. We only intend to bring you the data, and you are free to do what you will with it.

Future Sources on CityFALCON

We are always working on new features that benefit our users, and as a Big Data and AI company, this often manifests in the form of alternative data and metrics. Sentiment Analysis, summarisation, and company insights generated by our own calculations will be further sources of alternative data in the coming months.

So sign up for updates on the blog or CityFALCON itself to stay updated on what we’re offering. And if you haven’t, register for a CityFALCON account here.

Leave a Reply