As expected, in the first week we were settling down, and the real action started in the last week, week 2 of the program. Also on the business front, we had a very positive week at CityFALCON (touch wood!).

We got the money…almost

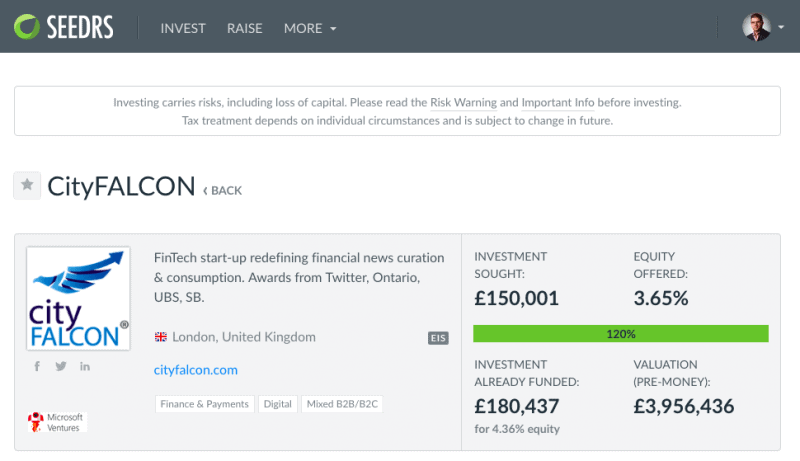

Last week our crowdfunding round on Seedrs got fully subscribed, and in fact we are now at more than 110% of the target right now. We will keep the campaign open for the next couple of weeks to get as much more money as we can get up to around £225K. To the outside world and media, it may seem like another FinTech company raised funds easily, but we’ve had to work really hard to get to this stage; juggling fundraising, product and sales has been tricky but feel very satisfied. In fact, equity crowdfunding has been one of the toughest things I’ve done in the last 3 years of entrepreneurship. At the same time, we’ve received quite a few requests for our API (which is how we make money), and with hopefully money reaching the bank in the next month or so, it’s time to get back to business. We are still waiting for people to transfer the pledged money on Seedrs, so please pay up 🙂

Next target for the team is to break even and be self sustainable by mid-2017.

Our campaign on Seedrs

Corporate perks are back

Running a start-up is like going back to the uni days – living on cheap sandwiches and thinking about every £ that you spend. One of the best news I discovered last week was the subsidised restaurant in the basement. Having recently turned vegetarian, I find it difficult to find good affordable vegetarian food in Central London. It was orgasmic to see a proper salad bar and a variety of vegetarian options. I felt really pampered when I was at KPMG, Nokia, Skype and Microsoft, and good to get some corporate perks during our time here at Octopus Investments. It’s also the time to check out the subsidised gym in the basement.

FinTech bonding and stand-up

We in FinTech love to collaborate – it’s a massive pie to disrupt and everyone can do well working together. For me, one of the best practices that every industry should adopt is the daily/weekly ‘stand-up’. It improves productivity, brings team members closer, and allows a project / product manager to see progress. We started our stand-ups at the accelerator last Friday – each of the 5 start-ups get to talk about 3 things – what did you achieve last week, what are they planning to do during the coming week and what are the biggest challenges they are facing.

FreeTrade kicking arse

FreeTrade sit across from us and are part of our cohort here at the accelerator. They provide zero commission share dealing, but more importantly are also a personal advisor for those who need help. This kick arse model and their vision won them ‘Innovation of Apps Award 2016’ at Apps World London this week. Apps World London claims to be “Europe’s largest gathering of mobile developers and startups.” They did a great job given the competition which included more established startups such as Revolut (Travel money card) and Chip (personal finance chatbot), and other startups ranging from Virtual Reality to B2B marketing to Nutrition tracking. It seems that the jury loved their theme of democratising access to the stock market and making professional advice accessible to a younger generation. You make us proud FreeTrade!

In non-accelerator related news…

YPlan’s debacle is unfortunate but could bring sanity back in the start-up world

The London start-up space was shocked last week at the announcement that Time Out are buying out YPlan for ‘only’ £1.6m in stock. YPlan had raised £31m from top VCs and was expected to be the next unicorn coming out of the UK. Let me start by saying that I’ve got a ton of respect for the founders for building such a strong brand, and a great product, and it’s a shame that they have had to sell out for such a meagre amount compared to the time and money they invested.

It’s unfair to judge them just based on what we hear in the media, but operating in the B2C space is tough mainly given the high cost of acquisition of customers. The ‘bidding’ for advertising on Google and Facebook inflates the prices, and at most times, the high cost per click and expected low conversion would mean that you’re paying more than the expected life time value of customers. The real winners of this all are advertising platforms such as Google and Facebook who are showing continuing jump in their revenue and profits.

I hope companies and investors will realise that growth at ANY cost is not how you build sustainable businesses. #staylean #growthhacking

Netflix looks like a good stock to short

At our fortnightly London Value Investing Club, we discussed whether Netflix is good stock to buy after the strong jump in international subscribers that got the markets and wall street analysts excited. Netflix now trades at an Enterprise Value of about $57bn, and with increasing competition in the space, may provide a good shorting opportunity to punters. I’ll try and get a detailed article out on this soon.

With some money in our pocket, I’m now going to stop my almost full time job of finding investors, and get back to business. Have a great week ahead!

Capital at risk. Investing in start-up and early stage companies involves risks, including loss of any initial investment and any reward, and it should be done only as part of a diversified portfolio.

Leave a Reply