It is time for another update on the CityFALCON journey. We had an outstanding year with new features, clients, and the development of our vision.

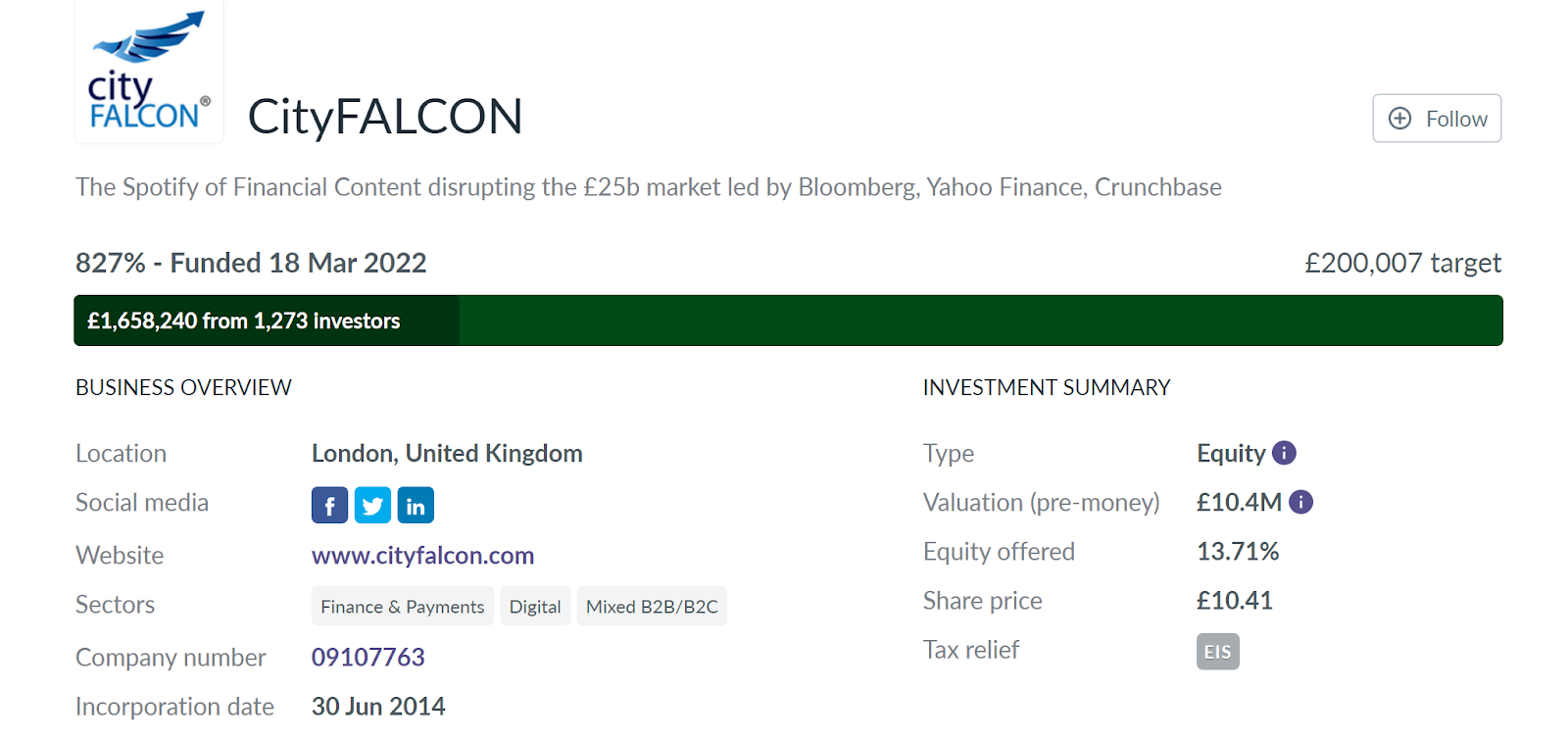

- £1.65m Seedrs equity crowdfunding round with a client, a fund, and a private company, among our 1200 investors

- Top new features

- Sentiment analysis for locations

- Confidence scores (via API) for sentiment

- Premium tab gathers all paywall-free Premium content in one place

- CityFALCON Score 1.5

- Dark mode for mobile

- New home page highlights all our best features

- New mobile home screen without registration

- CDN and caching for much faster responses

- New landing pages – explanations and visuals on all of our features

- Changes in Business

- 5 new clients, including eToro and and a Fortune 500 company

- Went through Holt XChange program – see our (dance) pitch video here

- Invited to blockchain API3 platform

EQUITY CROWDFUNDING RAISE

Read the blog post specifically on the raise.

To kick off the post, we are now live on Seedrs, where we are raising an equity crowdfunding round to retain long-term employees, fund our data and computing costs, and accelerate our marketing efforts with our new and improved product.

The fundraise closed at £1.65m from 1200 investors, including a client, a fintech fund, and a private investment company.

The client investment is a testament to their support for us and belief in our product.

NEW FEATURES

We have accomplished a lot in the past several months on the product side.

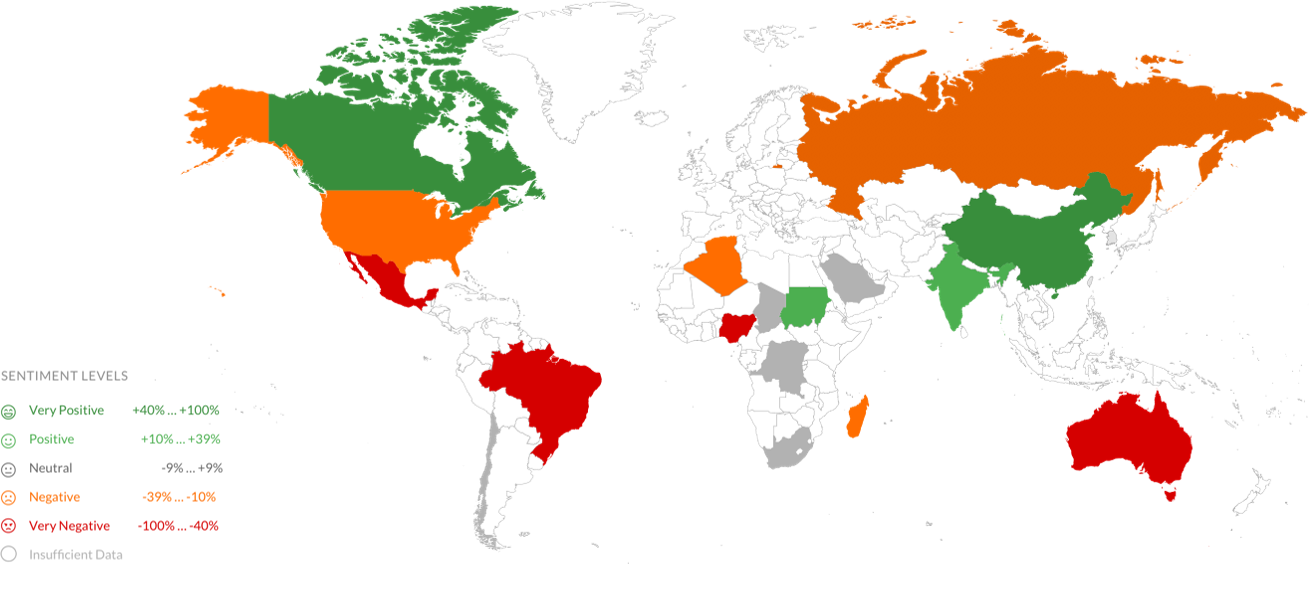

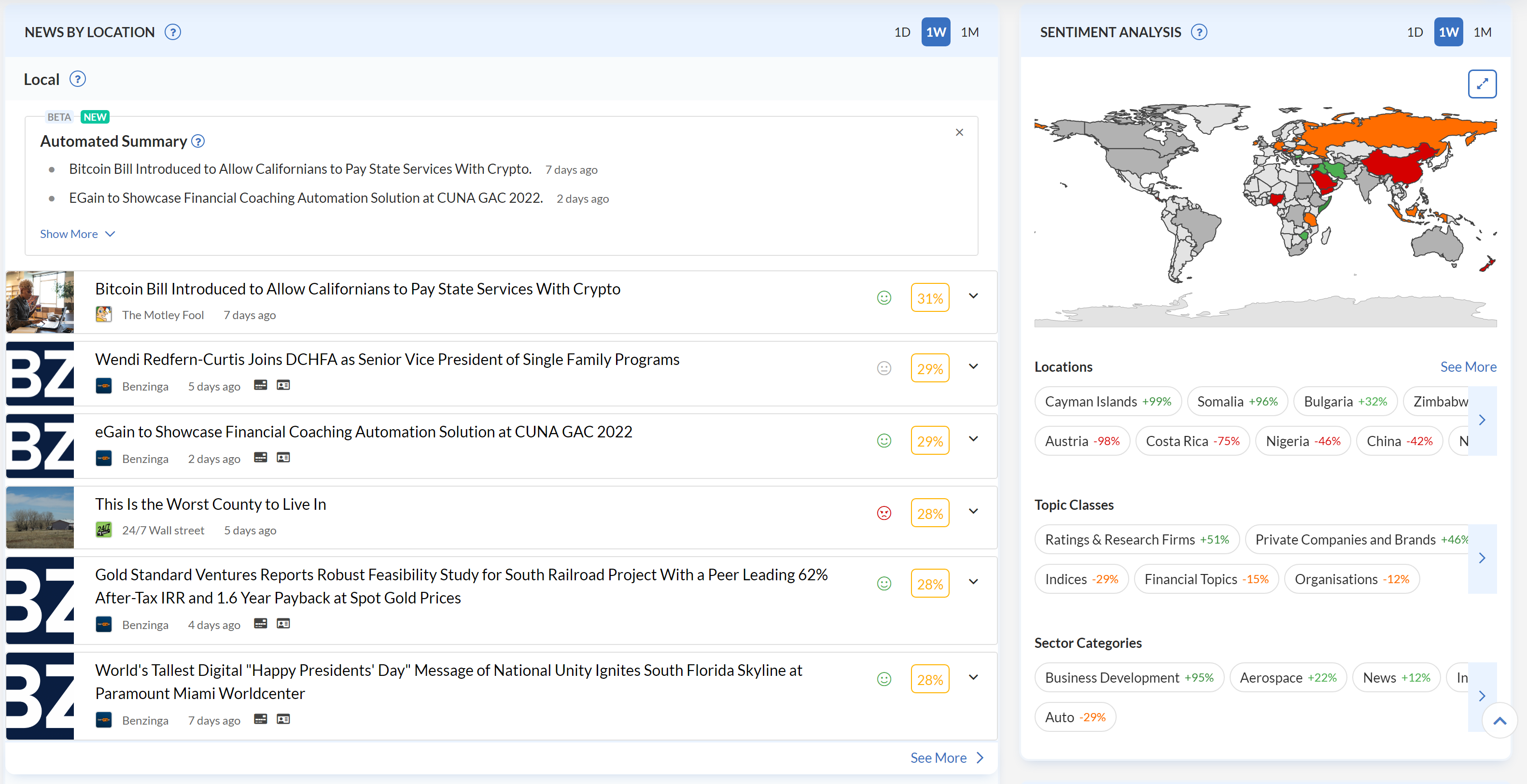

Sentiment for Locations

We had sentiment analysis already for each story (in the API) and for the entities, but now we have sentiment for locations, too. Location is best visualised by maps, and now you can click on any country and see the breakdown of sentiment for the country, the top stories, and the most positive and most negative regions in that country:

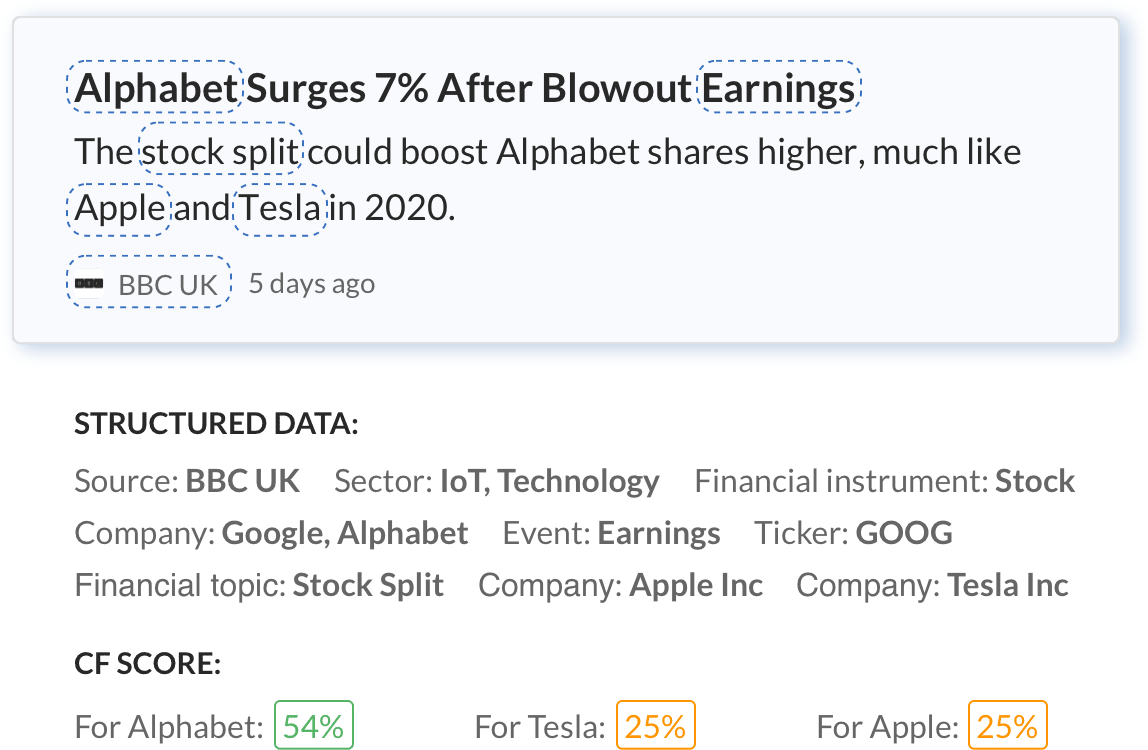

Confidence Score for Sentiment (on API)

We have launched a confidence score from 0% to 100% for aggregated sentiment. The metric is largely based on the volume of stories at the timepoint in question: more stories means more confidence that the score reflects reality.

Enterprise clients can already leverage the confidence score via the API. In the future we are launching a confidence score for our web- and mobile-based visualisations, too, such as the sentiment chart you can find on any asset in our database.

Premium Content in One Place

We display paywall-free content from top publications – that usually have paywalls – for select content from more than 1000 publications. These feeds are now available in a single location, on the Premium tab.

While watchlists and individual topics, like Tesla, can have their feeds set to display only Premium content through the filters, CityFALCON Gold users can browse content from specific publications, regardless of their attachment to a watchlist or topic.

CityFALCON Score 1.5

We’ve upgraded the CityFALCON Score to our next generation, 1.5. The score considers 20 different factors and incorporates elements like time and social engagement (likes/dislikes). The new time element means the CityFALCON Score is now more dynamic and responsive to changes over time.

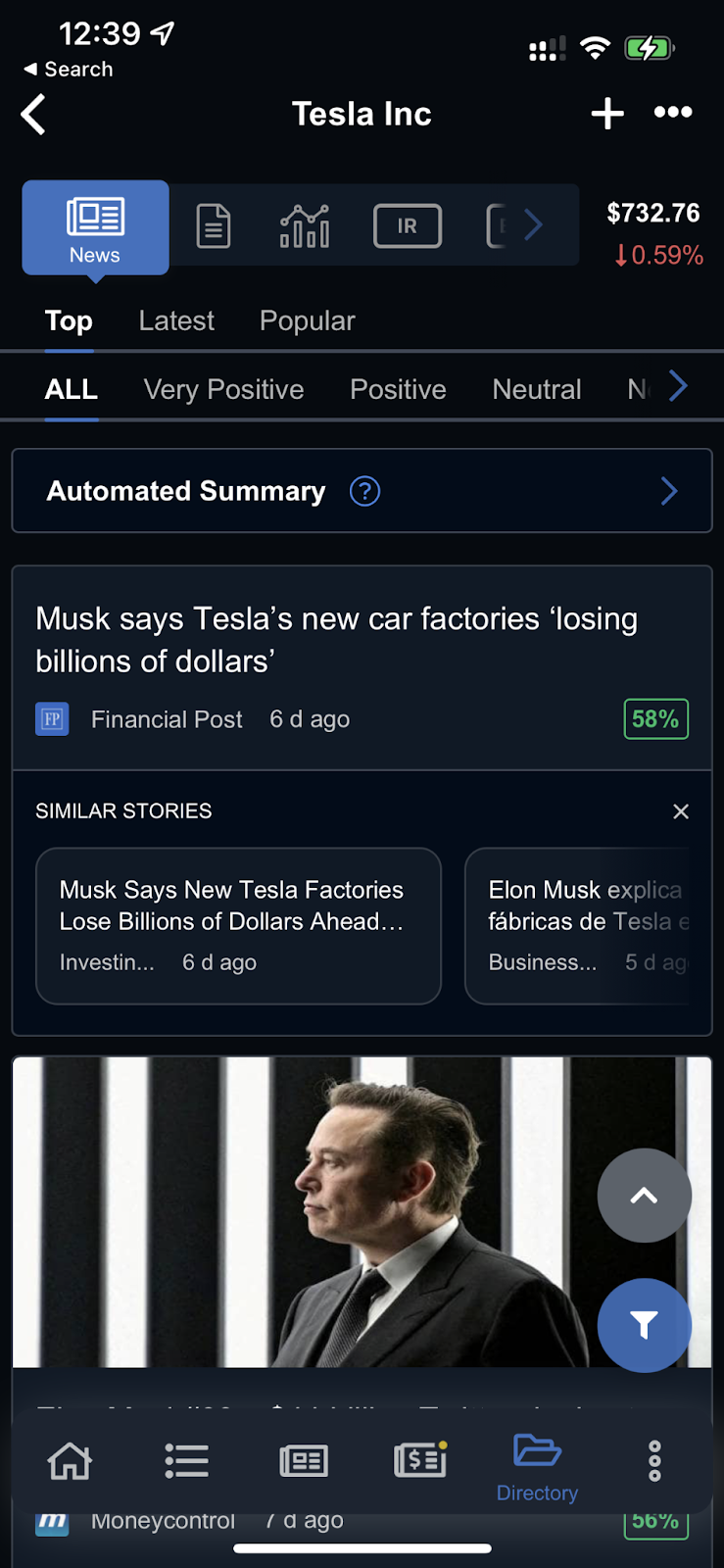

Dark mode on mobile app

For the mobile app we released a dark mode version so you can scroll your feeds and other financial content in dark environments – the markets never sleep, as they say. This is our first iteration and any feedback from you, our users, could be helpful in improving.

The web version is still in the works and will be released later this year. Make sure to get the latest version from the App Store or Play Store.

New Home Page

We’ve completely redesigned our homepage to highlight the most informational features and showcase all of the content in one place. We still offer granularity on the watchlists and specific company and named entity pages, while the new homepage is geared more towards the latest markets news.

If you want to be up-to-date on general financial content, you can leverage the homepage without building watchlists or anything else now.

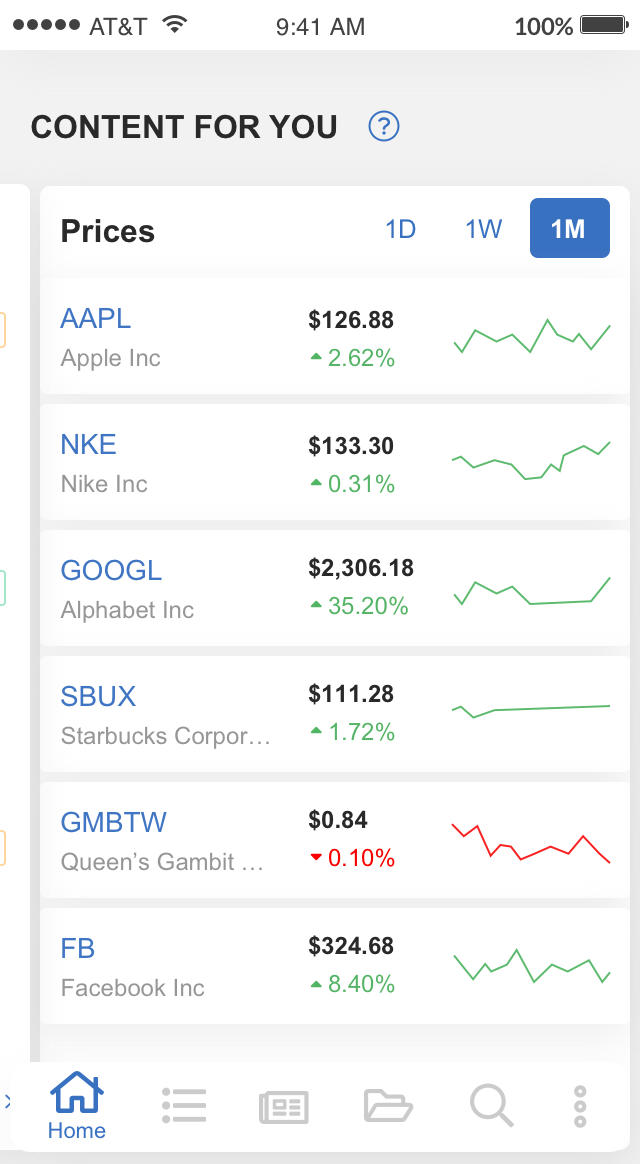

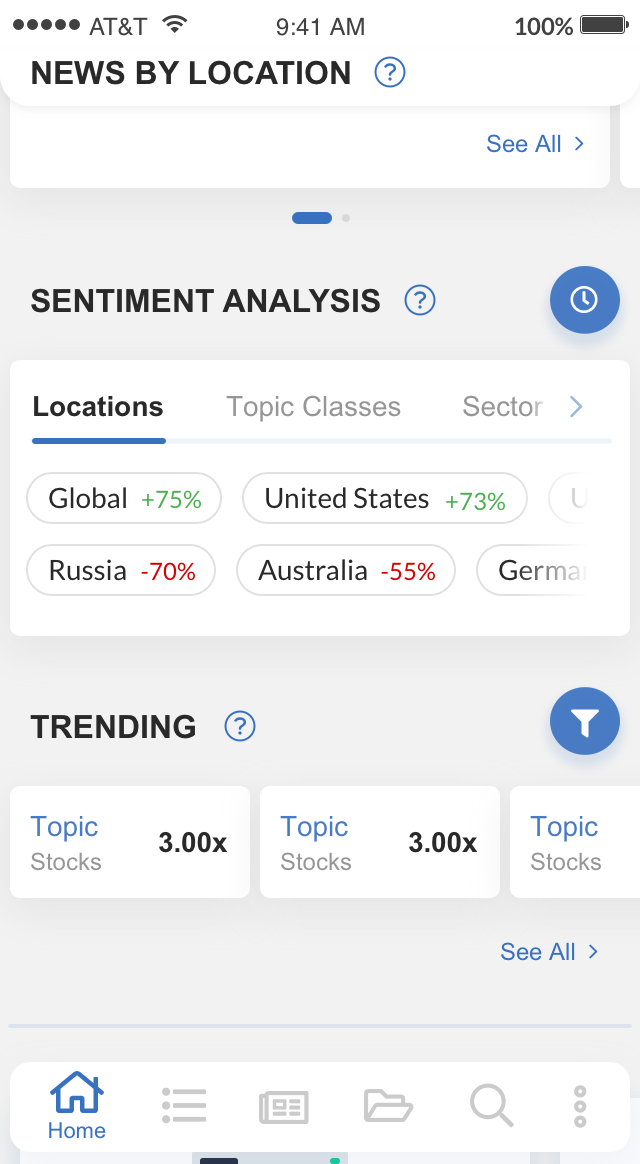

New Mobile Home Screen

In our mobile app we’ve launched a new home screen that reflects the changes on the desktop site. The new home screen showcases the most important features and provides a single portal by which to see the latest news on the most important topics without ever venturing into the more focused setup of the watchlists.

Stock Prices New Home Home Screen |

Mobile Home Screen Sentiment and Trends |

|---|

Make sure to download the latest version if you haven’t already upgraded, and rate the app and leave a comment when you have a chance!

Speed Up CDNs and Caching

Content delivery networks (CDNs) and caching are the backbone of fast internet delivery for global websites. In a nutshell, CDNs duplicate content in multiple geographic locations so that data is physically closer to the users, making download times faster and reducing latency and lag. Caching preloads data so that identical requests can be served without ever having to do extra processing on the database.

All the big, global tech companies do this, and now so do we. This makes it much easier for us to serve content to users around the world faster and more efficiently. You get information faster and smoother, while the money we save on processing costs can be used to develop the product further.

If you haven’t used the CityFALCON apps in a long time, try it out now. If you remember about 1.5 years ago, loading could be slow. Now, loading happens significantly faster in various aspects of the platform.

New Landing Pages

We are in the process of building out landing pages for all of our features. We use this pages both for marketing purposes for new clients and to explain the features more to current users. Parts of the CityFALCON platform can be sophisticated, so if you are ever confused on how to use a feature – or if you just want to learn how to better use the feature – you can visit our landing pages to understand better. We have video tutorials where applicable, too, so that you can see the feature in action and how it might be useful for you.

- Languages Coverages – which features are available in which languages

- Sentiment – for entities, watchlists, and stories (stories through API only)

- Summarisation – 100s of stories condensed into a few bullet points

- Investor Relations – documents like 10-Ks/Qs, earning reports, etc.

- Official Company Filings via API – from SEC, LSE, and Companies House UK (as of March 2022)

See these and more on our Key Features page.

CHANGES IN THE BUSINESS

This section details how the business has changed since our last update. We’ve accomplished a lot, and we believe these changes mean not only can we continue to bring you excellent financial content and analytics but that we have the resources to build upon our foundation to improve everything from user experience to quality of data and even first-in-the-industry features.

5 New Clients, including eToro

We’ve signed 5 new clients since our last update, including SMEs, and our biggest client to date, eToro. eToro is one of the world’s premier social trading platforms, and the integration lets anyone see news, sentiment, and investor relations content while they trade stocks, commodities, cryptos, indices, and FX.

A launch with a Fortune 500 company is imminent, too, and they’ll be using the data internally for their staff. The other three clients, all SMEs, include a financial data services company in Korea and two financial news platforms, one in France and the other in the UK.

These integrations have multiplied our annual recurring revenue (ARR) 2.6x from March 2021 to March 2022:

Annual recurring revenue (ARR) is calculated by multiplying MRR by 12. Our fiscal year ends in March and therefore we quote our March ARR. This calculation better reflects the situation for rapidly growing companies, as it accounts for newly-signed clients.In small, scaling companies, these new clients can be the difference between reaching breakeven or not.

Holt XChange Business Development Program

We participated in the Holt XChange program in Canada, bringing us investment and client leads. It was an excellent opportunity to break into the Canadian market and understand the fintech and startup ecosystem there. The fund invested in us in our latest equity funding round.

Check out our 6-minute pitch in person in the final days as Ruzbeh, our CEO, danced onto the stage with a live band accompanying him, then proceed to discuss our vision and accomplishments.

Invitation to API3 (a Web3 Platform)

We have been invited and agreed to participate in the API3 blockchain platform, which acts as an interface between Web3 applications based on blockchain and the traditional Web2 API that we provide. The initiative is designed to bring the old world of APIs into the new era of blockchain-based technologies, and we can see applications like searching for financial news to settle smart contract agreements.

If you have any interest in either our traditional API or interfacing via the blockchain, please do reach out to us at [email protected]. We’d love to hear your thoughts, suggestions, or use cases.

Leave a Reply