Disclaimer: This is a guest post from Michael Wiggins De Oliveira, and does not reflect the views of CityFALCON and its stakeholders.

Harte-Hanks

Date: 19/1/2017

Market Cap: $93m

Share price: $1.52

Valuation / target price: ~$2.50

Investment Thesis

Harte-Hanks (NYSE: HHS), has recently sold its crown jewel, for $112m in cash, which is more than the company’s current market cap. This cash (after tax) will be used to repay its debt leaving the remainder of the company debt-free. I think there is roughly 50% upside to the current share price.

Business Overview

HHS is a marketing company that offers marketing services in media from direct mail to e-mail, including agency and digital services.

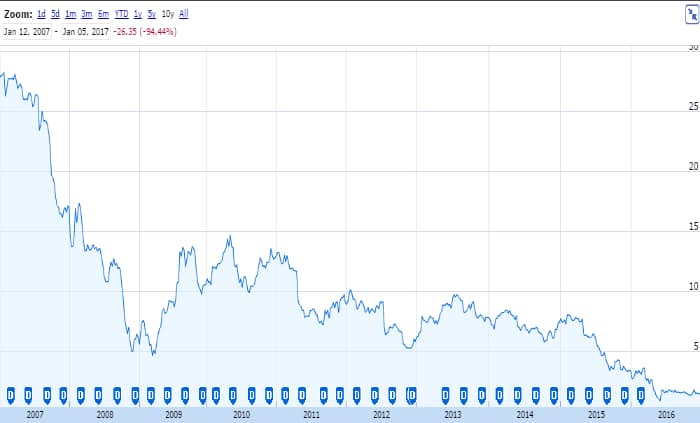

Its revenue has been declining year after year for the past decade. This has left shareholders very unenthused with the company’s prospects, as reflected share price in the chart below.

Source: google.com/finance

The contrarian investor in me says that while the market at the moment is mostly right, there is still on free puff left in this cigar butt.

“If you buy a stock at a sufficiently low price, there will usually be some hiccup in the fortunes of the business that gives you a chance to unload at a decent profit, even though the long- term performance of the business may be terrible. I call this the “cigar butt” approach to investing. A cigar butt found on the street that has only one puff left in it may not offer much of a smoke, but the “bargain purchase” will make that puff all profit.” – Warren Buffett

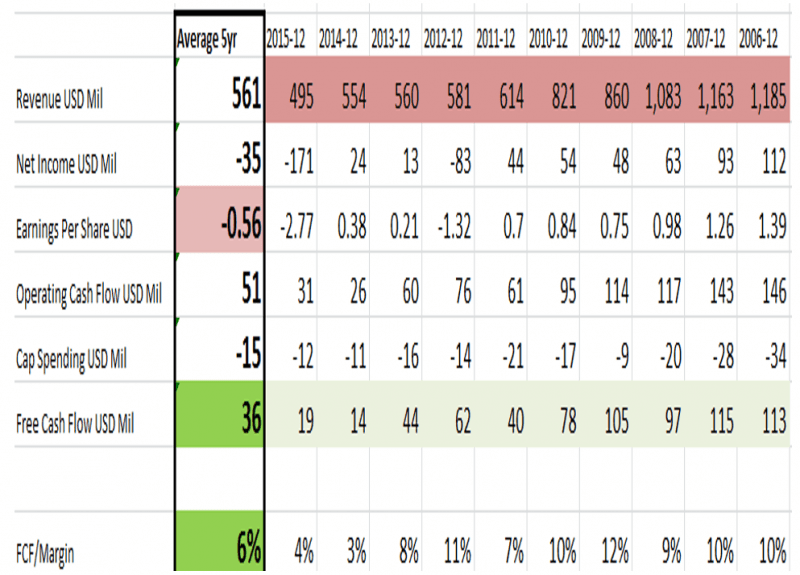

As you look at the financials below I have highlighted in red its declining revenues. I also highlighted in red the fact that over the last 5 years (on average) it has generated a $0.56 loss per share. However, and this is the key thing, is that loss is due to a significant non-cash impairments charge, mostly in 2015 to the tune of $210m. In order to confirm this, you can see highlighted in green that HHS has actually generated $36m in FCF on average over the last 5 years.

Furthermore, while many investors prefer to seek out companies with high Returns On Equity (ROE) as a proxy for a great business, I personally prefer to seek great businesses that are reflected on the cleaner metric of high Free Cash Flow divided by sales (FCF%). The two metrics go largely hand in hand, but ROE is influenced by leverage and FCF% is slightly less influenced by this. Typically, I tend to consider business with FCF% above 5% as good business. Of course, there are many truly great businesses that are growing very fast that are reinvesting all their cash so the FCF will be smaller, but traditional value investors have difficulty forecasting the future. As a quick side note, traditional value investor, such as me, put a lot of emphasis on the past performance of the company with no weight on future growth. Walter Schloss one of my favourite investors would solely look at the cost it would take to replicate a business (a sum of the part analysis) and pay significantly less than that – margin of safety principle. While this certainly does not always work, through diversification it does work well over time.

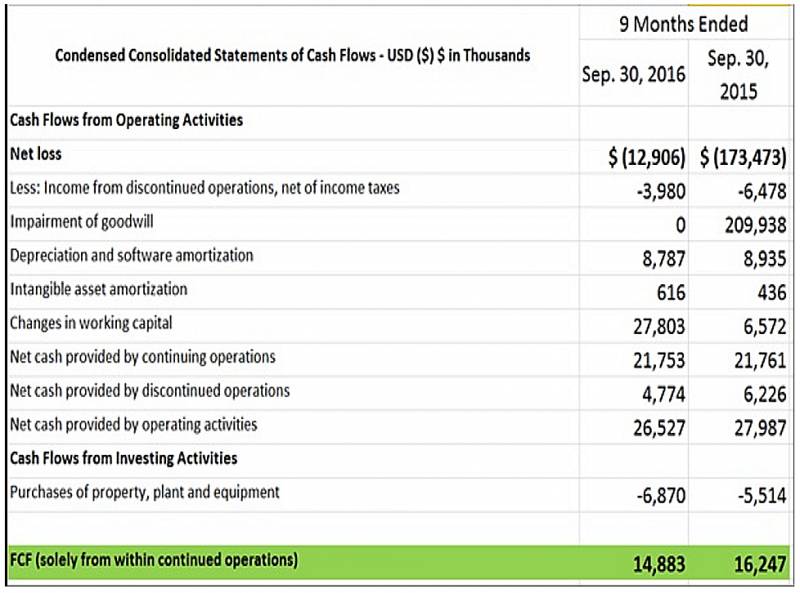

I did a back of the envelope analysis on what HHS had generated over the last 9 months and how it compared with the same 9 months a year ago (this is solely from HHS’s continuing operation excluding any effects from Trillium that has now been sold). This takes into account any seasonality as I am just doing a like for like analysis and tells me what HHS tends to generate. Over the last 9 months, it generated ~$15m in FCF (see below).

Now, remember, this is only for 9 months, not the full year. So let’s just be very conservative and say that HHS does not make any additional FCF over the next 3 months of the year. Here you have a company that generates $15m trading for roughly $95m market cap (and debt-free) or a 6x multiple on free cash flow.

Now the bear argument, which is very pertinent here is that HHS’s revenue has been declining over the past decade. This is a very valid argument and that is why the stock is now sold short 31%. But as a deep value investor, I think that the more shorted the stock the better, as traders that are currently betting short are fully committing to repurchasing the stock at a later point. Of course, those traders are betting that they will buy back at a cheaper price, but they are committed to buying back the stock, nevertheless. If I am right that the stock is undervalued, once the stock starts to appreciate there will a short squeeze.

Insider Ownership & Purchases

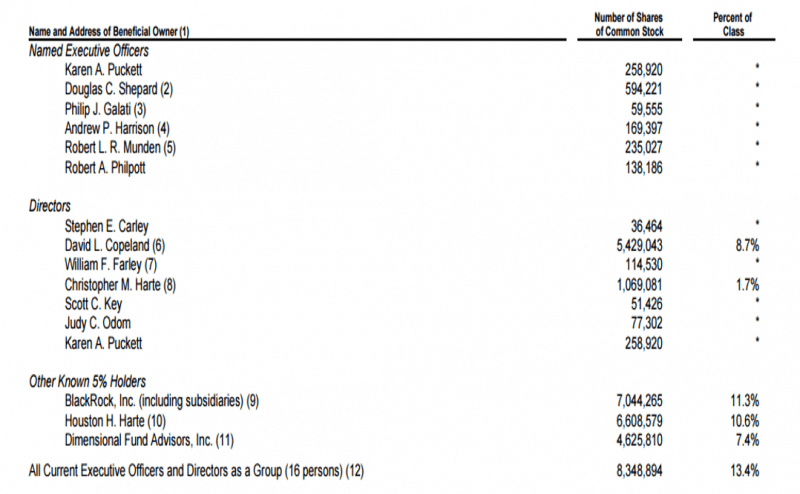

I always like to see how insiders are incentivised to turn the company around. For this, I check how much stock in the company insiders own and what if any are the recent share purchases and at what price. I believe that capitalism works and if people have the correct incentives they will be motivated to do the right thing. As you can see in the table below, insiders own a respectable 13.4% of the outstanding stock.

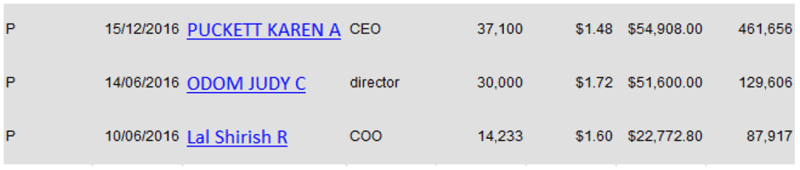

Also, as the table below shows, there have been some tentative shares purchases from management, with Ms. Puckett buying roughly $55k worth of stock at $1.48.

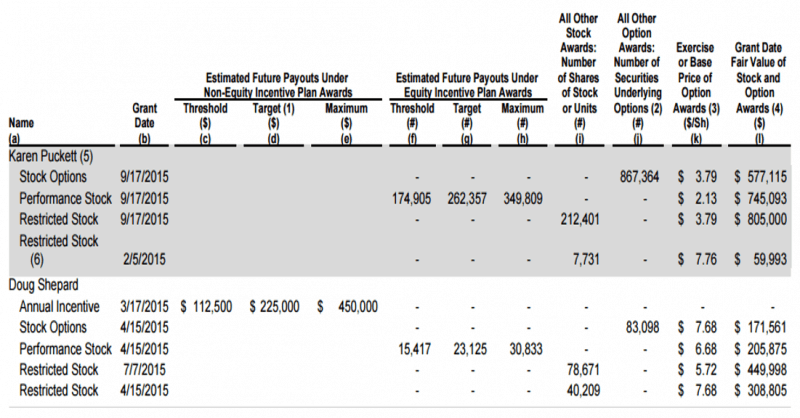

While these are not large sums by any measure, management has little incentive to buy additional stock in their own company, as they already get a large amount of stock through the company “Equity Incentive Plan” (see below). For management to buy stock in addition to what they already get from compensation package they must believe there is money to be made.

Sanity check

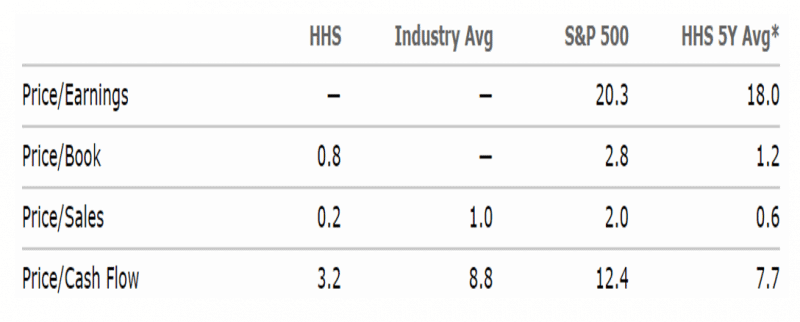

I like to compare how the company currently is priced versus what it has traded for over the past 5 years. I consider this a very quick and dirty sanity check that I am not, in fact, overpaying for a “story”- stock.

My favourite metric is the P/S. I like it because it is quite a clean metric. I like to compare what investors have been willing to pay for a stock over the past five years and what they are willing to pay for it now. In the past five years, investors were happy to pay 0.6x P/S. Currently, investors are asked to pay only 0.2 P/S, which is at least 50% cheaper than the 5-year average.

Conclusion

Any investment in HHS will not for the faint hearted. It may take longer than 1 year for good news to start percolating through its financials. In the meantime, its share is heavily shorted and will be very volatile. Any bad news and the shares will fall 20%-30% in a single day, but unemotional investors that are fully dissociated from the share price as an indicator of whether they are right or wrong in the short time will most likely stand to benefit in a satisfactory way with an upside of 50% over the next year.

Disclosure: I am long HHS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it.

If you’d like to track real-time relevant financial news for Harte-Hanks check it out here.

Leave a Reply