Dow breached the 21000 mark for the first time today, S&P and Nasdaq hit record intraday highs post Trump speech. Overall, the US stock market s are up more than 10% post elections driven mainly by anticipation of “phenomenal” tax reforms, fiscal boost and financial deregulation.

But is this rally sustainable? Consider this:

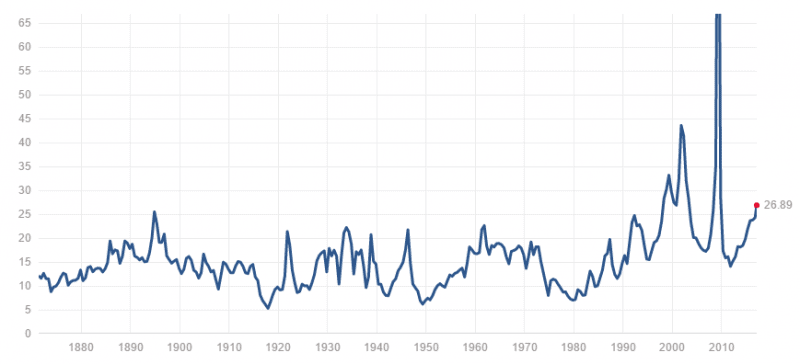

1) The S&P500 Shiller PE (Cyclically adjusted PE ratio – CAPE) is currently at 29.52, about 77% higher than the historical mean of 16.7. This level has been exceeded only a few times before – including the housing bubble of 2008, dot-com mania of the 1999 and Great Depression of 1929, indicating that the current market is grossly overvalued

2) This puts immense pressure on the earnings to match up these high valuations. Agreed, earnings are expected to receive a boost from lower taxes from Trump tax reforms, but policy specifics remain elusive and execution could face congressional headwinds. Further, labor costs are expected to rise, given that the economy is at full employment. High labor costs combined with a rising dollar could eat into the tax aided rise in corporate earnings.

3) Again, the markets are banking on a rise in corporate earnings from tax cuts. Such govt. aided profits do not necessarily reflect innovation and efficiency, do not aid value creation in the long run.

Will it be a bumpy ride ahead?

Leave a Reply