Some people must have hated 2022 when they realised that “stonks go up!” is not always the case. Regardless of the pain, one day this experience will be appreciated as a great learning moment, for those that stay in the game. The stock market decline taught the new generation – and reminded those that forgot – that valuations matter.

If a company trades for a price that is not justified by the fundamentals (overvalued), it is a matter of time before it returns to earth, sometimes calmy, sometimes crash-and-burn style. Often, the business does well, and the growth is still there, but it’s not enough to sustain the insanely high price. In other cases, growth decelerates and does not agree with the expectations that were set. There are many situations where overpaying can lead to losses. To buy undervalued stocks and avoid the overvalued, you must follow these three steps:

- Find the market price of the company.

- Find what the company is worth, the intrinsic value.

- Compare price with value, and act with patience and reason.

The first step is easy, but many do it wrong. The second step is an intersection of art and science. The greater the information, analytical skills, judgement, talent, and immunity to cognitive biases, the better. The third step is where most investors fail, because it doesn’t require intelligence, but a stable mind that can focus on the long-term and the mentality of an owner.

This first post is for complete newbies. Those who already understand how share prices and market capitalisation interact, stay tuned for the next post about Step 2 above!

Find the market price of the company

In this part, you are to learn about a concept that will completely change the way you look at stocks and stock prices. Especially if you are a newbie, expect an aha moment. It will change the way you analyse and interpret things. It will massively accelerate your learning in investing, and make you realise that the prices you used to track were a delusion.

As in other areas in your life, price is the first thing to ask to find out how cheap or expensive something is. Instinct tells you to do the same for a company, and ask for the price per share, because you buy shares.

For example, (TINGO), trades for $0.57, and AMCON Distributing company for $182 per share. Without knowing anything else, from the price alone, you might conclude that AMCON is a company that investors are willing to pay a lot to buy, while TINGO trades for peanuts. Counterintuitively for beginners, the comparison is totally nonsensical.

A share is a fraction of a business, making you a real partial owner. It’s naive to ask what the price of one fraction is. The price of one slice will just tell you how big the slice is and nothing about the price of the whole. Caring about the price of one stock is like worrying about paying in $1, $5, or $10 dollar notes for a whole $70 – you need only 7 $10-bills or 70 $1-bills, but it’s the same $70 price tag for the item. Still, many investors pay attention exclusively to the price of one share.

If I tell you the fraction of a house will cost you $50, do you really know anything about the house’s price? You obviously do not think the house itself and in its entirety costs $50. This partial price means that the cost for the whole house can be from $50 million, when divided in 1 million fractions (shares), to just $50K when divided into 1,000 shares.

— How much is a slice of pizza, please?

— It’s only 30c, sir!

— That’s awesome, can I have five pieces?

— Yes, take your 5 crumbs

This is how silly it is to check the price of one share when you are an investor who cares about value; traders may have different metrics and approaches that may not care at all about the whole pie but just their slice. A more sophisticated and meaningful “price tag” is to find the cost of the “whole pizza”. That’s easy, you multiply the price of one piece, with the number of pieces, and there you are, you have the price of the whole pizza.

In stocks it’s equally easy, calculated the same way. You multiply the share price with the shares outstanding, and you get the total amount to acquire the whole business, called the Market Capitalisation.

Let’s get back to Tingo and Amcon, and compare them in terms of their “whole price” – market capitalization. Tingo consists of 1.23 billion shares. To buy all 1.23 billion shares you need to pay about 700$ million (1.23 billion shares x $0.57 per share). Amcon consists of only 611,052 shares, so to acquire it, you need only $111 million (611K shares x $182 per share). So which one trades for more?

So next time:

— How much is the price of the pizza, please?

— It’s only 30c, sir!

— Hmmm, I see the pizza! But, how many pieces do you cut into?

— 100 pieces!

— So you want me to pay $30 for a Pizza? Have a nice day!

Pizza Price = Piece Price * Number of Pieces

Market Capitalization (overall company price) = Stock Price * Shares Outstanding

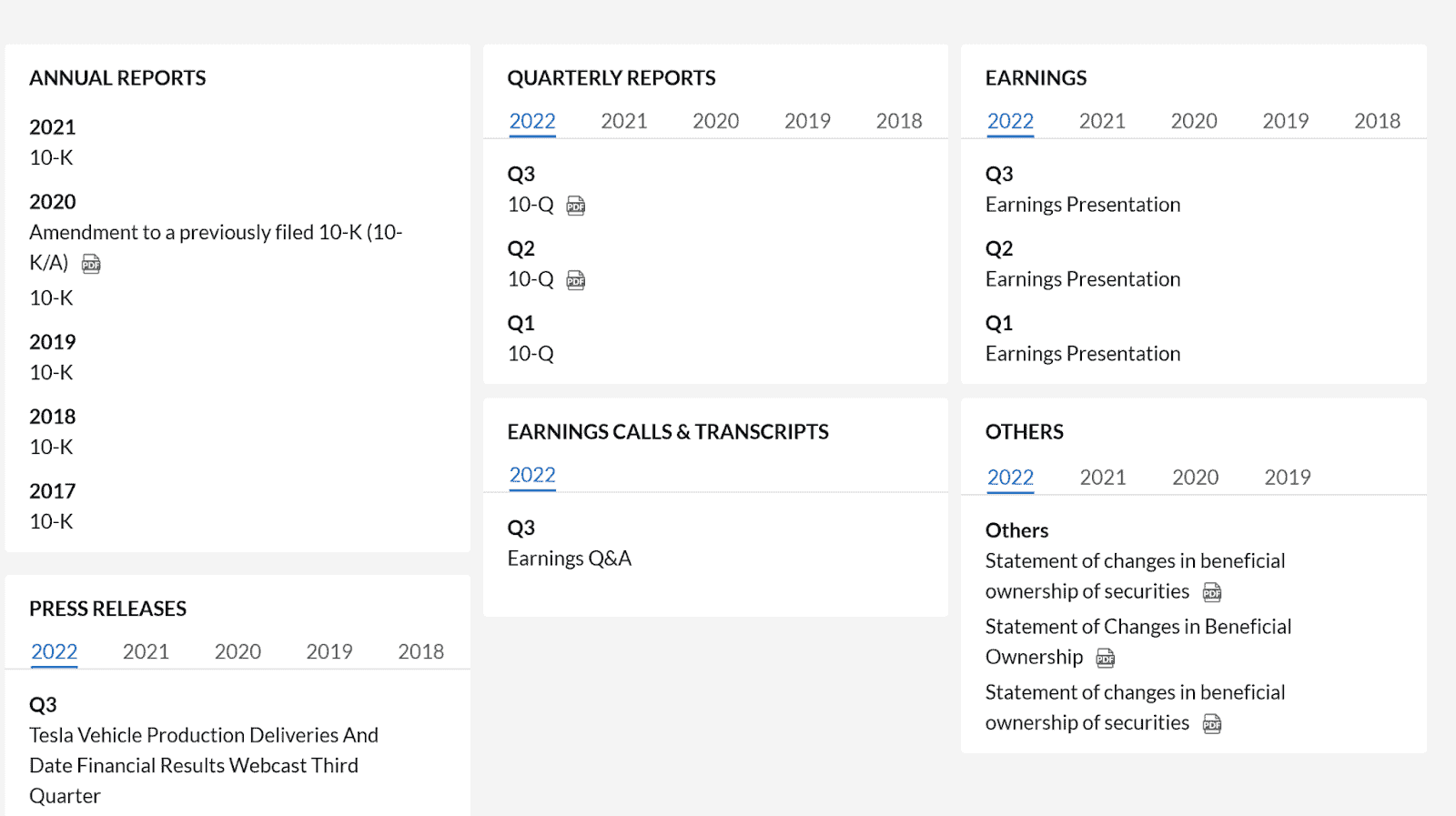

Shares Outstanding is publicly available information, disclosed in companies’ annual (10-K) and quarterly (10-Q) filings. It’s easy to find all these documents together at CityFALCON’s IR tool for the company of your interest (e.g. Tesla), and the market capitalization at Charts & Data.

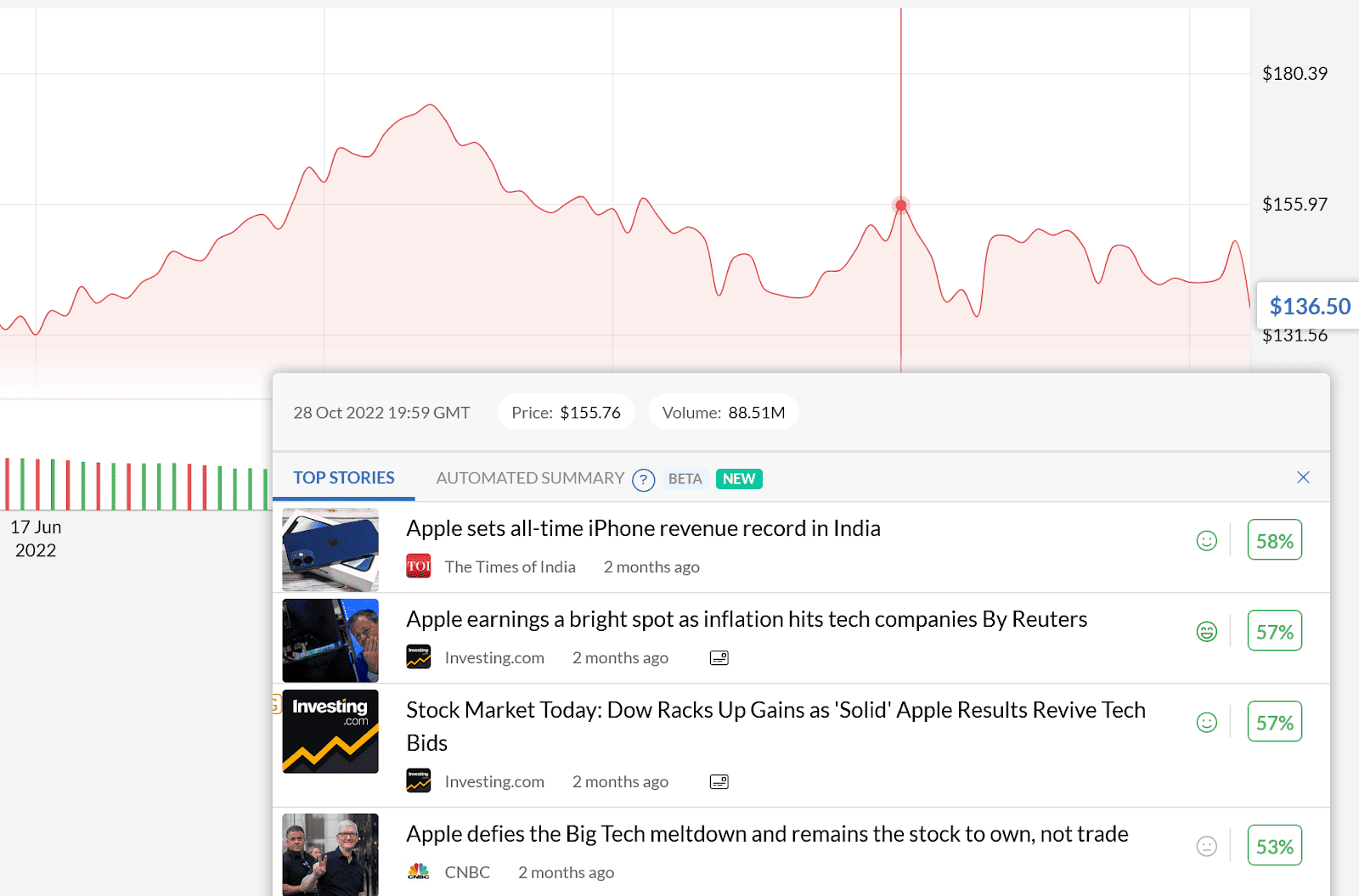

A cool feature of this section is the hovering news on a chart, to know which news are related to the price movements. See an example for Apple.

When you deeply conceive the idea of market capitalization, share price will be just a reference point for comparison. You will care to know the overall price, and then take a deep look into the company’s overall picture and financials to see if it is reasonable. It seems small, but it’s a big first step. Move from stock price to market capitalization. Enjoy your new lenses!

This video can also help you understand the concept.

To know everything going on about your companies, create watchlists and receive personalised content, aggregated from thousands of sources, and curated to reduce the noise.

Also, follow us on Facebook and Twitter, because in the following days we will announce a quiz for testing your #investing knowledge. Accept the #challenge to answer, and win a £100 cash or CityFALCON Gold plan ($60-190 value). Stay tuned!

Why do penny stocks get a bad rep? Some big companies can have low-value stocks, but oftentimes low share values can mean trouble. Read more on penny stocks (and crypto prices).

Step Two on how to find what a company is worth, the intrinsic value, is coming soon!

Merry Christmas!

DISCLAIMER

Content presented on our blog does not present any recommendation for stock transactions. Metrics, like the market capitalization, may contain errors. All investors are advised to conduct their own independent research into individual stocks before making a purchase decision.

Leave a Reply