In this article, we will explore why studying regulatory filings and corporate disclosures are critical for informed investment decisions. We’ll highlight key filing types like 10-Ks, 10-Qs and 8-Ks and their significance. Using real examples, we’ll show how filings provide essential insights that impact stock prices. Finally, we’ll outline methods to efficiently track filings across companies and markets.

Regulatory filings and investor relations (IR) documents contain a wealth of information that can be invaluable for making smart investment decisions. As an investor, it’s essential to keep up with these sources for any companies in which you own stock or are considering investing.

Why reading just news and analyst reports is not enough

While financial news outlets do report on company filings and announcements, they often prioritise attention-grabbing headlines over substantive details. Journalists may cherry-pick interesting tidbits from a 200-page filing to drive clicks, leaving out critical facts and context. Headlines also frequently skew negative, playing up risks and problems over steady progress.

Likewise, analyst summaries rarely capture the full picture conveyed across lengthy filings and investor materials. Analysts understandably put their own spin on developments based on models and expectations. But this injects subjectivity from the analyst, who may not entirely align with your investment needs, whereas gathering insights directly from the source avoids (the analysts’) subjectivity. As a result, journalists and analysts alike may overlook or misconstrue information that could offer valuable investment perspectives.

There is no substitute for reviewing primary documents like 10-Ks and earnings presentations yourself. The news and opinions you read after the fact will never provide the same level of comprehensive insight. Avoid the risk of missing something that you deem important but that others may not by going straight to SEC filings and investor relations materials for investment research.

The Different Type of Filings

Annual, Quarterly Reports, and Proxy Statements, Press releases

SEC filings provide details on a company’s financial performance, business strategy, risks, executive compensation, legal issues, and more. For example, Apple’s FY 2021 10-K filing revealed revenue increased 33% year-over-year to $365.8 billion driven by new iPhone and Mac models. It also disclosed supply chain challenges that could impact sales. The basis of these important details may be covered in news and analysis, but diving deeper can only be accomplished by going to the source.

The numeric financial data presented in 10-K and 10-Q filings offer invaluable perspective for investors. The income statement, balance sheet, cash flow statement and other tables provide granular performance metrics beyond high-level headlines. Viewing raw numbers allows for objective calculation of ratios and growth trends. While compiled tables using extracted data are useful for quick comparisons, original documents contain comprehensive breakdowns and numerous sections with detailed tables.

Bed Bath & Beyond (BBBYQ) stock had rallied during January 2023, but with the release of the 10Q on 26 Jan, it was obvious that the company was in a precarious position. The quarterly report revealed that the company “does not have sufficient resources to repay the amounts under the Credit Facilities and this will lead the Company to consider all strategic alternatives, including restructuring its debt under the U.S. Bankruptcy Code.”

The stock was very volatile, and initially there was a price spike in the days after the earnings release, despite the alarming facts. This is because, short-term, a stock may move up just because of speculation, regardless of the reality painted in the filings. However, the stock collapsed in the following months, and in April, the company filed for bankruptcy. Investors listening only to news would only be able to speculate about the future because they would have a narrow view of the situation, whereas those that leveraged filings would have a much more comprehensive view. By reading the 10-Q, numerical facts, notes, and all other regulatory announcements they would be able to judge by themselves and realise how severe the situation was.

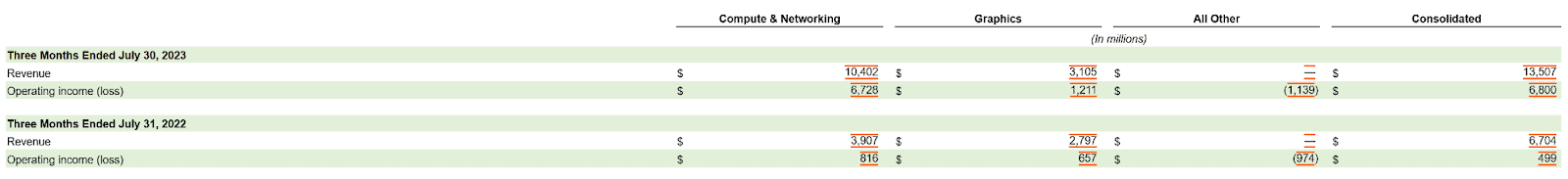

Nvidia published its Q2 FY 2024 10-Q showing that the revenue and earnings have exploded due to the AI chips demand. Going through the report you can see the actual numbers in detail, and how each segment performed. Going through about 50 pages of data, you will notice details and facts that matter, such as tables that break down elements (debt, intangibles etc), like the one you see below for the segmentation of revenue.

Also, the management discussion and explanatory notes truly differentiate filings. They deliver context around financial results and business drivers not captured in tables alone. Executives comment on factors impacting specific line items, units, geographies and more. These qualitative insights help discern whether financial shifts represent temporary effects or substantive trends.

8-K filings disclose major events like mergers, CEO changes, or cyber attacks. They may also provide updates on those events. For example, in May 2022, Broadcom ($AVGO) filed an 8-K including the announcement for acquiring VMware at $61 billion valuation

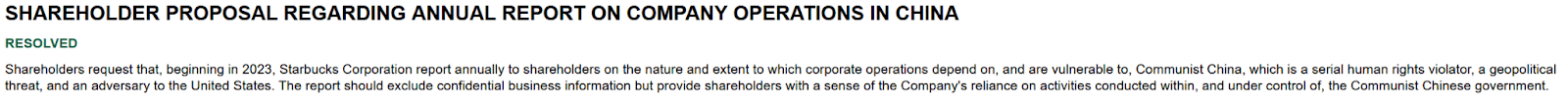

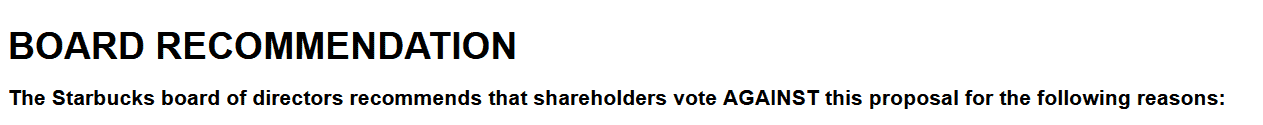

Proxy statements allow investors to research and make informed decisions on matters put to shareholder vote. Key sections to study are: corporate governance policies, director biographies and independence, executive pay plans and rationale, auditor information, and shareholder proposals. Proxy statements provide transparency into board composition, executive compensation philosophy, oversight policies, and more.

For example, the latest Starbucks ($SBUX) statement contains several shareholder proposals. In this case, the board recommends a vote against the proposals, but both the proposals, and the reasoning of the board helps the understanding and evaluation of the company and its management. The nature of these proposals is often ESG, and they rarely get supported by the majority.

An example of a shareholder proposal and the board’s response follows:

Insider Transactions from SEC Form 4

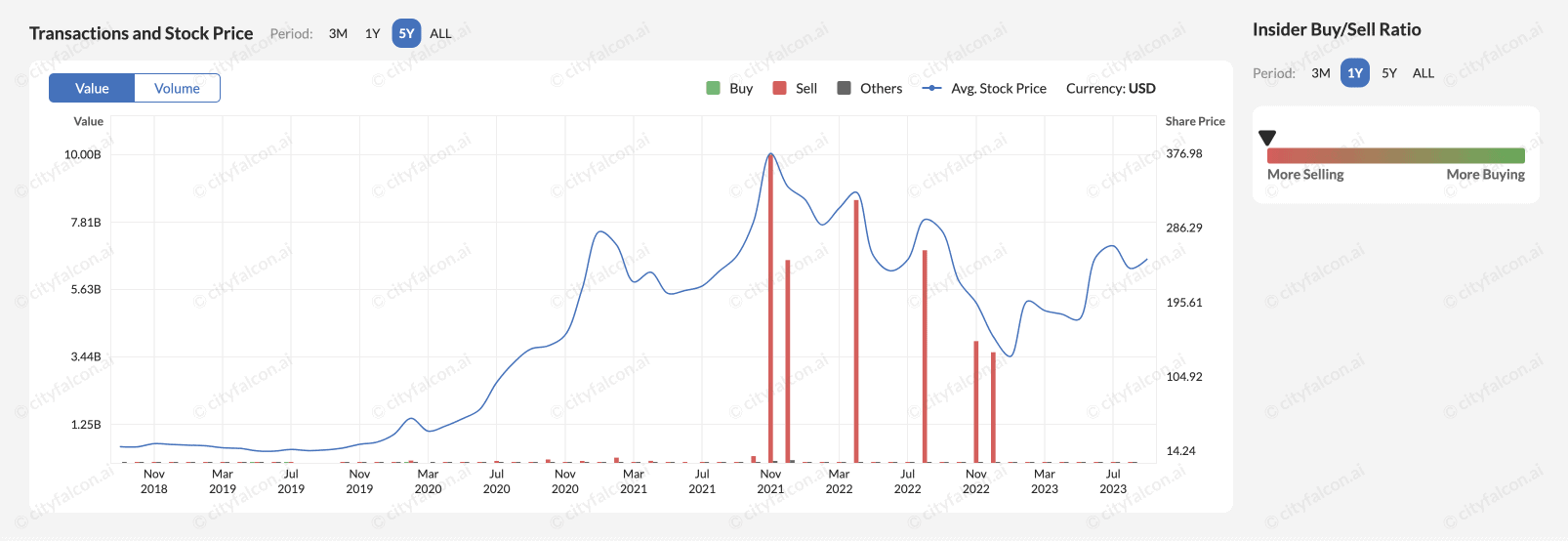

Tracking Form 4 filings provides visibility into insider transactions at a company. These filings disclose when executives, directors and major shareholders buy or sell stock. Monitoring Form 4s can identify trends like insider buying which may signal confidence. Conversely, increased insider selling could raise flags about motivation. Following insider transaction activity doesn’t guarantee better investment performance, but it can supplement perspective on management’s outlook. Used prudently, Form 4 data affords helpful context around those most familiar with the company’s fundamentals and direction.

An example is Elon Musk selling big amounts of Tesla stock just after the stock price peaked. You may read more on insider transactions and how you can evaluate them in this article. A good approach is to use tools like the CityFALCON Insider Transactions (see graph below), to have an overall picture, and also easily access each filing for the details. Isn’t it really interesting that there was pressure on the stock during the period of heavy insider selling?

Earnings Call Transcripts & Investor Presentations

In addition to SEC filings, companies release investor presentations, earnings call transcripts, and other IR documents that provide valuable context and commentary. These materials help explain the numbers in SEC filings and offer strategic insights from management.

For example, companies use earnings presentations to highlight key performance drivers, new growth initiatives, and future outlooks. Call transcripts give direct access to management Q&A. Investor day events go in-depth on operations and financial models. Tracking IR resources brings SEC filing data to life.

The questions posed by analysts on earnings calls often reveal key topics of concern. Analysts may press executives on delicate issues or problems that impact operations, finances and strategy. Reviewing the Q&A section provides visibility into the sensitive areas analysts are probing. The nature of the questions themselves highlights risks, challenges and uncertainties facing the company.

Additionally, management’s responses provide clues to how transparent executives are willing to be. Dodging tough questions or providing vague answers could signal problems. Thoughtful and substantive responses demonstrate management’s commitment to transparency and proactive communication. Investors can gain valuable perspective on management’s candour, capability and strategic direction from the dialogues prompted by analyst questions on earnings calls.

The MD&A (Management Discussion and Analysis) section provides unique insights into management’s view of the business. It contains valuable perspectives on operations, financial results, challenges and risks.

Analysing the MD&A over time allows you to assess management’s candour, consistency and competency. You can judge whether executives deliver on their promises and handle crises effectively. Tracking how management explains performance provides a gauge on their honesty and transparency. The MD&A ultimately helps investors evaluate the capability of leaders to navigate future challenges and opportunities. Its perspectives can speak volumes about the strategic direction and culture being set from the top.

Tools and Sources

Now that you know why these resources matter for your portfolio, here are some tips for accessing them and staying on top of them:

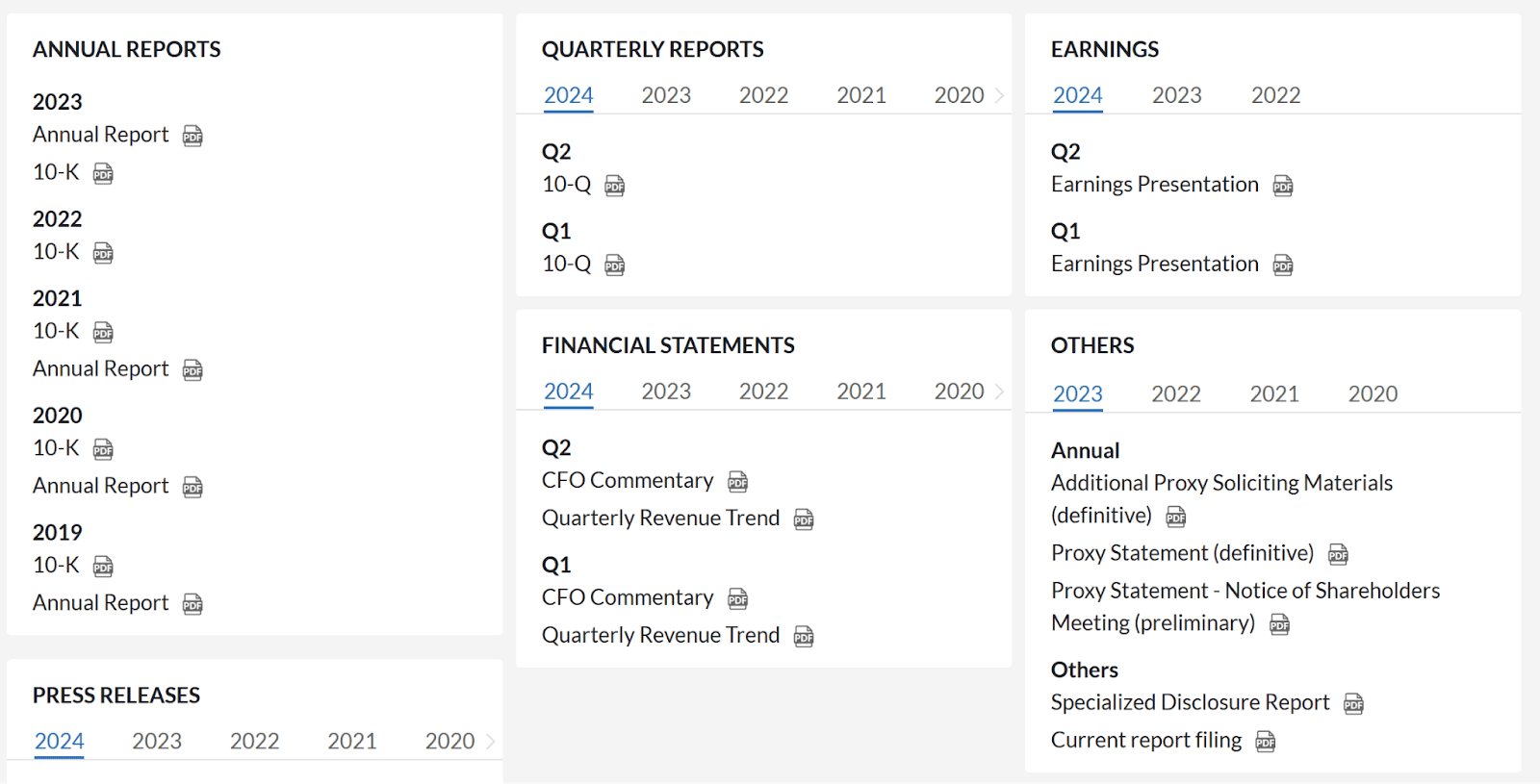

Public companies provide an investor relations (IR) section on their websites where you can find all regulatory filings and corporate disclosures. For example, Tesla’s IR site has sections for SEC filings, quarterly reports, presentations, webcasts and more. However, company IR websites can sometimes be disorganised, making it difficult to locate specific historical documents spread across multiple pages. Moreover, you’ll need to navigate to each portfolio company’s website, find the right page, and constantly check for updates across them.

You can also access filings directly from regulatory authorities, like the SEC for the U.S. But this requires familiarity with each country’s specific agency and system. For global investors, finding documents across different markets introduces more complexity.

A third option is leveraging financial platforms that consolidate company filings and other IR documents in one place. For example, CityFALCON, through the IR tool, compiles all regulatory filings, earnings releases, annual reports, and presentations chronologically, and per category, on a single page. This centralises historical and current disclosures for an efficient research workflow and means updates come to you, instead of you seeking the updates across potentially dozens of pages, structures, and formats.

It’s even more powerful when combining the IR tool with CityFALCON watchlists. Investors can create watchlists of companies and have everything unified in one place: news, filings, and IR feeds. This eliminates the need to hunt for information across multiple sites and filter out what you don’t need. With watchlists, all relevant disclosures for your portfolio stocks or prospective investments are in one dashboard.

On top of that, you may use Push Notifications and Email Alerts to be tipped off by news that could make you want to dive deeper, so that you don’t miss out on anything important.

The key is identifying resources that organise access across regulators and companies for streamlined research. Leveraging platforms, like CityFALCON, tailored for investors, saves significant time and ensures critical filings do not slip through the cracks.

You can subscribe to CityFALCON today and use our tools for the companies of your interest. Create Watchlists, discover Insider Transactions, monitor Investor Relations documents, and set Push Notifications and Email alerts.

Sign up for FREE to use most CityFALCON features. Sign up to an affordable Gold plan for quick, easy access to filings, investor relations documents, translation, paywall-free content, and more.

Leave a Reply